The landscaping market is a multi-billion-dollar industry, making it one of the most interesting business niches worldwide. However, nowadays, succeeding in a landscaping business requires more than hard work and quality service. The administrative side of the business, like bookkeeping, invoicing, and preparing tax reports, must be accurate and efficient for your success and growth.

Working with a job and doing manual accounting at the same time is not an easy feat, more so if you are a landscaper who works for himself. This proves the significance of having the right accounting tool at your disposal. You need accurate bookkeeping and financial statements every month, but instead, you’re often left with limited time to focus on the accounting side of your business and no reports to show for it.

So, if you are looking for ideal accounting help, you have come to the right place. In this article, we will discuss the top 5 accounting software programs for self-employed landscapers who manage their accounting by themselves. We’ll compare their features, costs, and benefits to help you find the perfect tool to simplify your bookkeeping while maximizing your business’s financial health.

Our best tested picks

- Moss – Best Spend Tracking Solution for Landscapers

- FreshBooks – Best Overall Accounting Solution for Landscapers

- Xero – Best for Deeper Financial Insights

- Zoho – Best For Growing Landscaping Business

- Melio – Best For Small Business Payments

These Are The Best Accounting Programs For Landscapers

We’ve carefully evaluated over 20 accounting programs, analyzing them according to landscapers’ needs, and filtered the top 5. Some of these software are designed as all-in-one accounting solutions, while others focus on specific areas like spend management and advanced cash flow management.

While selecting these accounting programs, we have focused on the specific needs of a landscaper, such as, ease of use, mobile capabilities, project management, etc.

Here is our detailed selection criteria while selecting these programs:

- Ease of use: One of the main criteria while selecting these programs was ease of use. As a site worker, you don’t want to spend hours finding your way through different features of your accounting software. Complex systems require a lot of work and time, and cause time waste and errors. These programs offer a simple interface and easy navigation, so on-site usability is very easy

- Job Costing: Quality accounting programs provide the job costing feature, one of the most important aspects of bookkeeping. Tracking every cost reveals exactly which types of landscaping work generate the most profit. Many landscapers discover that certain services they’ve offered for years actually lose money when all costs are properly allocated.

- Invoice and Bills: AProfessional and customizable invoice helps you improve your brand image in front of customers. The embedded payment link in the invoice allows you to collect payment sooner and from various gateways. Additionally, you can automate recurring payments for the service, which saves you time when creating a fresh invoice.

- Reports and Forecasts: Advanced accounting platforms analyze your usage and give alerts on inventory and cash flow, which prevents hiccups in the last minutes. Monthly, quarterly, and yearly business reports tell the overall health of your business. Without a detailed business report, your growth will be hindered as you won’t be able to focus on where to improve.

Top 5 Accounting Programs for Landscapers

We’ve done a detailed deep dive into the following software. From its primary use cases to small features, we’ve tried to cover everything so you can make an informed investment in your accounting software.

- Moss: Best Spend Tracking Solution for Landscapers

- FreshBooks: Best Overall Accounting Solution for Landscapers

- Xero: Best for Deeper Financial Insights

- Zoho Books: Best For Growing Landscaping Business

- Melio: Best For Small Business Payments

#1 Moss – Best Spend Tracking Solution for Landscapers

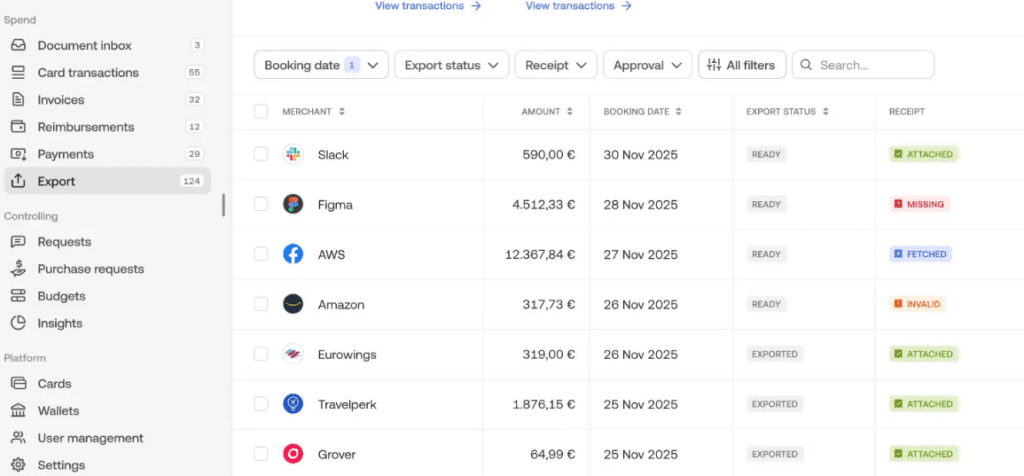

The most common mistake landscapers make is neglecting project costing. Spend tracking is one of the most critical parts of bookkeeping, and mismanagement leads to distorted financials. Moss is expense and spend management software specifically designed for tailored workflows that track budgets in real time.

Landscapers who manage their accounting can easily store data for each card transaction, invoice, and reimbursement, automatically with the help of advanced integrated AI tools in the Moss software.

Expert score 4.7 |

Key Features

Effortless Expense Tracking

- Moss requires minimal manual input because of its advanced automated expense tracking.

- OCR and digital receipt management help track costs with one snap.

- The categorization and report-making expenses are also automated.

- Moss’s automatic reconcile feature helps you save time on account payables during month-end closing.

- You can issue virtual credit cards with limited budgets and smart tracking for employee expenditure tracking.

- The software automatically and securely collects data from card transactions, reimbursements, supplier invoices, and payments.

Accounting Integrations

- Moss can be connected with major accounting software like Xero and DATEV to improve efficiency.

- Through e-invoicing, Moss reads the data from invoices automatically and then can pay directly via Moss or a bank.

- Two-way integrations with leading accounting software keep everything up to date.

Secure Payments

- Moss offers secure domestic and global payment transfers.

- SEPA instant payments in EEA and UK instant payments.

- An integrated bank account helps to clear account payables instantly without any external gateway.

- Download the transaction and transaction report anytime to reconcile payments.

- Cash back for high transaction volumes on virtual and physical card spending.

Key Benefits For Landscapers

- Moss offers cutting-edge automation tools that can significantly reduce the accounting workload for landscapers.

- AI-powered expense management helps landscapers handle numerous small purchases of supplies and materials, saving hours of manual data entry.

- Accurate cost tracking can control wasteful spending, increasing your overall profitability.

- You can confidently rely on Moss for proper and accurate documentation of tax reports.

Moss: Customer Support

- Onboarding Support: Moss provides new customers with dedicated onboarding support staff so that new users can easily navigate the software.

- Easy use: In 2024, Moss was awarded Capterra’s Best Ease of Use Badge for the Accounts Payable and Expense Report categories.

- Customer Support: You can contact Moss’s customer staff by phone or email from Monday to Friday between 9 a.m. and 4 p.m. Also, a help center is established with detailed articles on recurring queries.

Pros and Cons

Pros

-

Robust automated spend tracking system

-

Diverse integration options with top accounting software

-

Easy to use and intuitive interface

Cons

-

Not a full-fledged accounting program

-

Limited regional functionalities

-

Customer support can be a headache sometimes

#2 FreshBooks – Best Overall Accounting Solution for Landscapers

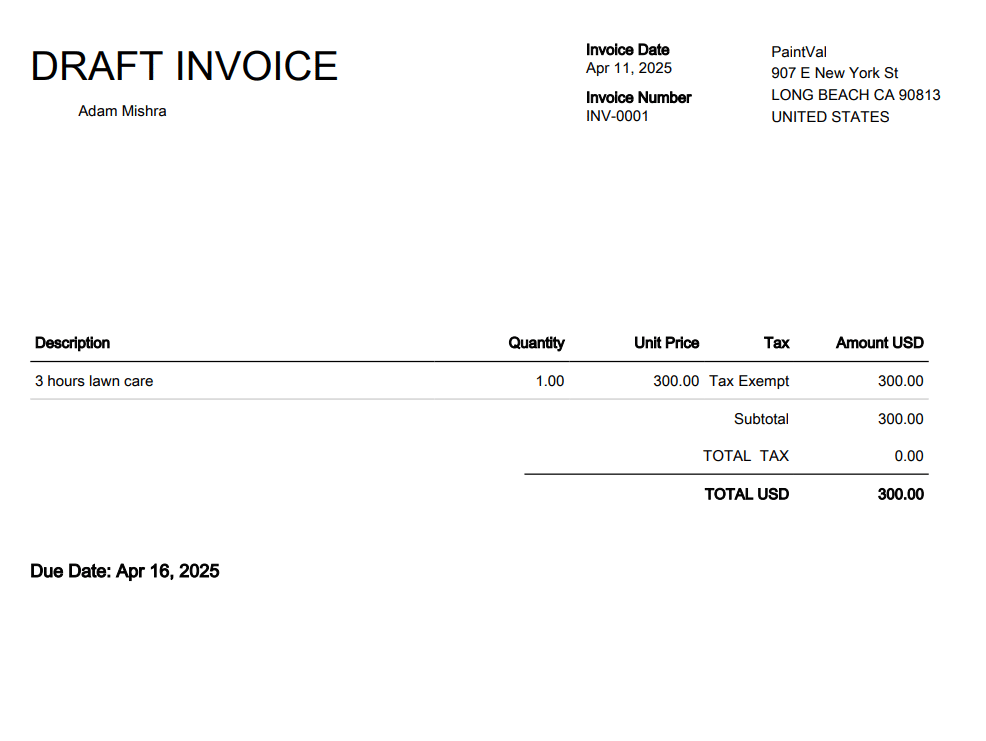

FreshBooks is a cloud-based accounting software known as a one-stop solution. While Moss focuses primarily on expense management, FreshBooks covers bookkeeping, payment, and report analysis in a single platform.

FreshBooks offers multiple features needed for service-based businesses like landscaping. The program provides various essential tools like project tracking, cost categorization, and profitability analysis that make it easy to determine which types of jobs (maintenance contracts, one-time installations, seasonal cleanups) generate the most profit for your business.

Expert score 4.5 |

Key Features

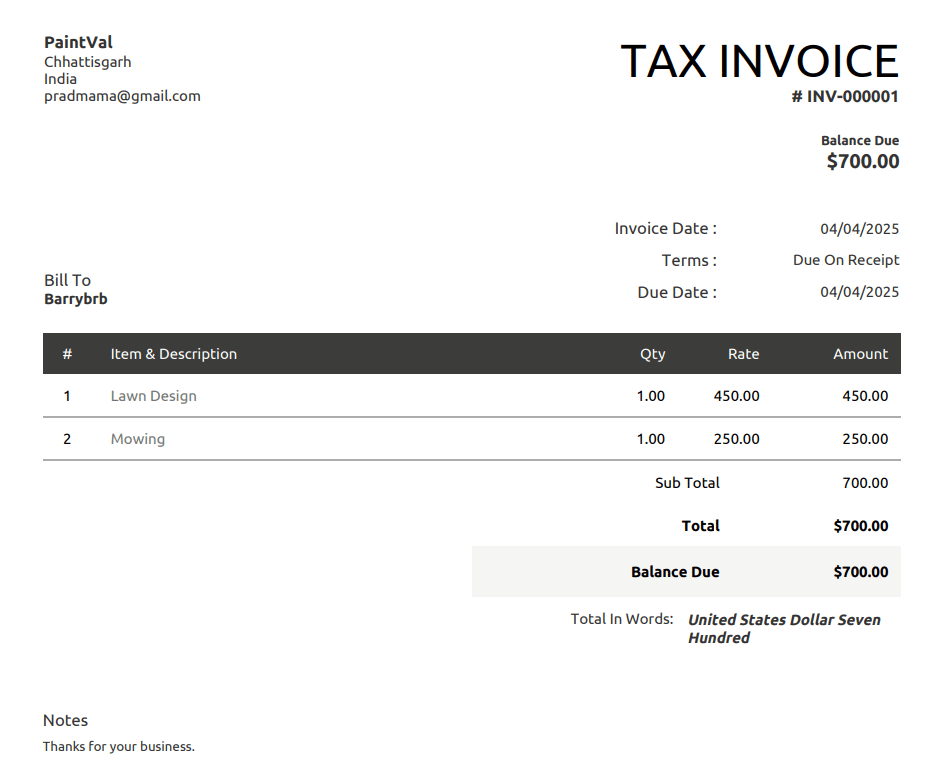

Branded Invoicing

- FreshBooks allows you to create and send professional invoices with payment integration.

- The logo and brand can be customized using the various templates provided.

- FreshBooks lets you set up recurring invoices for regular customers.

- The program monitors the invoice’s activity and tells you when customers receive and view invoices.

- Immediately after work, invoices can be created on-site with the mobile application.

- Tracked time and bills can be directly added to the invoice, saving you the extra logging work.

Project Reports

- FreshBooks allows you to create estimates to quote to clients.

- A straightforward dashboard and reports tell you how your business is performing.

- Accurate profit and loss reports show areas of improvement in financials.

- Pre-made quarterly and annual financial reports will save you time and make tax season stress-free.

Expenses and Receipts

- FreshBooks allows you to connect your bank or credit card, so you don’t need manual entry to track expenses.

- Automatic mobile receipt scanning allows you to log and categorize expenses instantly.

- You can mark expenses as billable, add a markup, and automatically add them to client invoices.

- Real-time mileage and time tracking for accurate costing.

Diverse Payment Options

- FreshBooks allows flexible payment methods, such as credit cards, PayPal, Apple Pay, and bank transfers.

- ACH connects to most major banks in the U.S.

- One-click payments can be made through the link in the invoices.

- Post Checkout Links on your website, social, or anywhere else online to simply let customers click and pay.

Mobile Functionality and Integrations

- The mobile application provides access to all these features, including invoicing, automated expense tracking, and payment.

- CRM and other payments apps can be integrated into FreshBooks.

Landscaper-Specific Benefits

- Landscapers can create professional estimates and invoices easily through the mobile application.

- Profitability reports will help landscapers focus on the areas that can bring high growth to the business.

- Insurance, service, management, equipment, and marketing expenses can be easily logged with an automated scan that categorizes the expenses according to the projects.

- Various payment gateways allow landscapers to collect payments quickly and easily.

FreshBooks Customer Support

- Dedicated Support Staff Assistance: FreshBooks’ support team has a high rating in the public reviews on Trustpilot- 4.8/5.0. Landscapers can contact FreshBooks Support services through phone, email, and chat.

- Comprehensive Knowledge Base: FreshBooks provides an online knowledge base and webinars, offering users information and self-service support options.

Pros and Cons

Pros

-

One-stop solution for accounting purposes

-

Mobile application comes in handy for on-site work

-

9 a.m. to 5 p.m. EST phone support on working days

Cons

-

Limited person accessibility even in the higher-tier subscriptions

-

The mobile application doesn’t allow report generation.

-

Lacks the crucial inventory tracking and vendor management feature

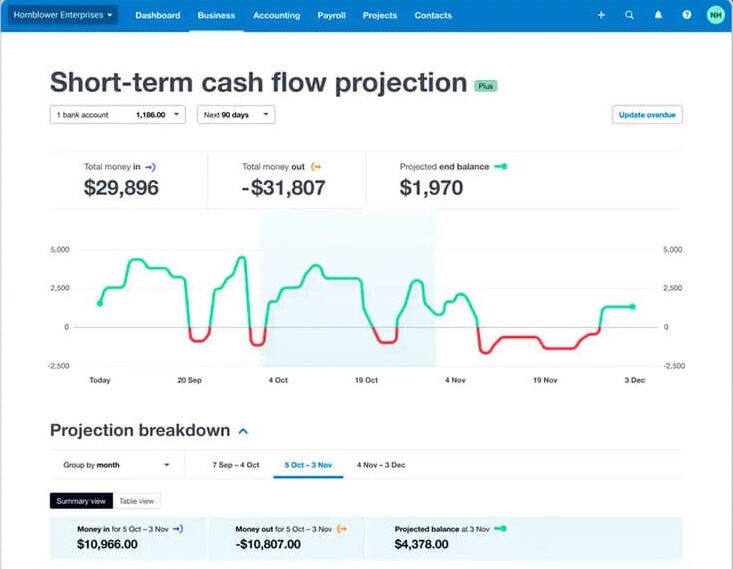

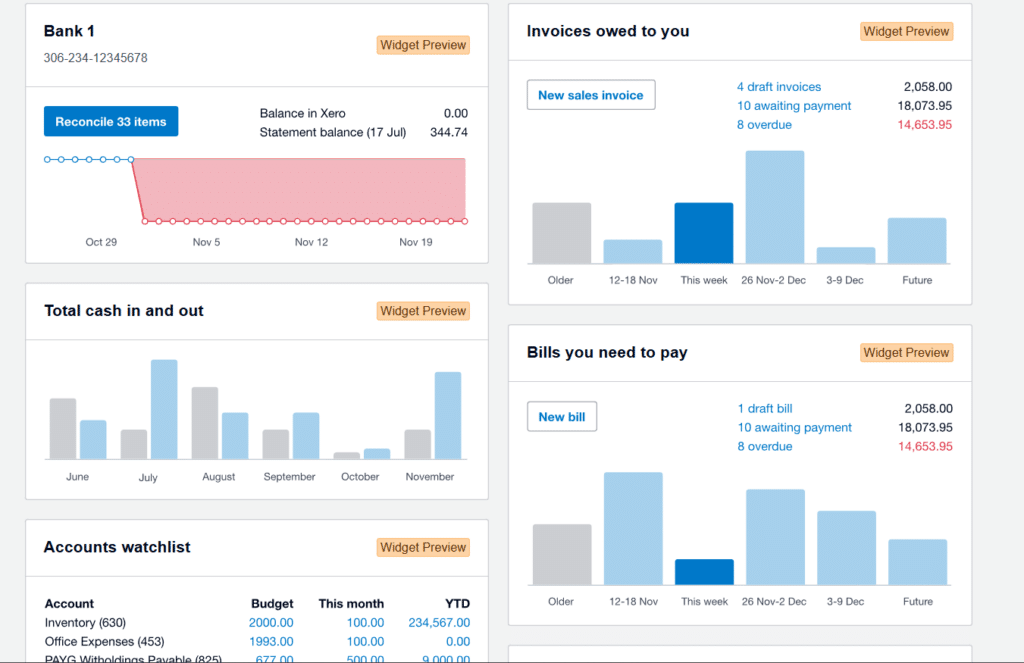

#3 Xero – Best for Deeper Financial Insights

Xero is an online accounting solution that goes beyond basic accounting. With basic invoicing and billing, Xero offers advanced general ledger controls for landscapers who want deeper financial insights or work closely with accountants.

The platform also provides a full suite of reports to assess your business health anytime. One standout feature of Xero is that you can have unlimited users free of charge, which is not possible in FreshBooks or any other major accounting platform.

Expert score 4.3 |

Key Features

Ledger and Cash Flow Control

- Xero offers complete ledger control with a full record of transactions.

- You can efficiently track receivables and scheduled payments and learn about your cash position.

- Xero’s cash flow forecast tools are very helpful for landscapers dealing with seasonal cash flow variations.

- You can place alerts for specific thresholds in your cash flow, saving you from last-minute headaches.

Project Tracking

- Xero’s project tracker allows you to track project time and mileage with its start–stop timer.

- Link your bank and the software will update expenses and categorize them according to projects.

- You can upload all the expenses from any receipt with a single snapshot.

- See where each dollar was spent to help you manage your project budgets.

- Bank reconciliation helps you keep records up to date.

Invoicing and Budgeting

- Provide instant estimates and quotes, allowing clients to understand forecasts while you track your profits.

- Create professional and customizable invoices on different templates.

- Payment links can be integrated into the invoice for streamlined payments.

- Set automatic reminders for payments and recurring invoices.

Taxes and Analytics

- Xero provides tracking of depreciation on expensive landscaping equipment, saving time for taxes.

- Profitability dashboard shows your financial condition with a detailed profit and loss statement.

- You can monitor the breakdown of costs, including what needs to be improved.

Key Benefits For Landscapers

- Xero forecasts cash flow for the short term and the future, helping landscapers prepare beforehand.

- Simple and efficient bookkeeping and professional invoices help retain customers.

- Accurate time-tracking for time-based landscape workings.

- With Xero, you can produce tax reports that show tax obligations, freeing you from tax worries.

- With Xero’s mobile application, you can invoice on-site billing to get payment faster.

Xero: Customer Support

- No phone support: Xero does not offer phone support for customers, which is a limitation. In case of any problem or query, you can only reach out to email support.

- Xero Central: Xero has created a dedicated online web page that provides information on various issues.

Pros and Cons

Pros

-

Simple interface and easy to use

-

Detailed financial reports and cash flow forecasts

-

Track every cost with bank integration and automated receipt upload

Cons

-

Hard to reach customer support as there is no mobile support

-

Base subscription limits certain features

-

New upgrades have been criticized by users

#4 Zoho – Best For Growing Landscaping Business

Zoho Books is a part of the larger Zoho suite that provides comprehensive accounting facilities. You can create detailed estimates for complex landscaping projects, convert them to invoices once approved, and track all expenses against specific jobs.

Zoho’s inventory management features are particularly valuable for landscapers who maintain stocks of plants, hardscaping materials, or supplies. If you want additional features like CRM, you can integrate other programs like Zoho CRM and Zoho Projects for a full-fledged business management tool.

Expert score 4.2 |

Key Features

Automation

- You can set up payment reminder emails that go out automatically a week before the invoice is due, on the due date itself, and even a week after if you still haven’t gotten paid.

- Zoho Books allows automated report generation on a weekly, monthly, quarterly, or annual basis.

- With the automated expense manager, you just need a snapshot of the receipt, and all the costs will be uploaded and categorized.

- You can build your own custom tools using Zoho’s proprietary coding language.

Inventory Tracking

- Organize and manage your inventory with SKUs, images, and vendor details.

- Inventory alerts help you keep tabs on your stock levels at all times.

- You can convert purchase orders into invoices instantly.

Quotes and Invoice

- Zoho Books allows you to create quotes on the spot with personal details, item details, and prices that can be created in seconds to win the deal.

- Customizable invoices and quotes can be created easily in the mobile app.

- Turn a quote into an invoice as soon as your client accepts it, saving you time from creating a new invoice.

- Payments can be done directly through an invoice in multiple currencies.

Project Management

- You can track billable time or mileage with ease.

- Role-based access in Zoho Books for a team makes accounting easy.

- The dashboard report shows your total income and expenditure, including receivables, sales, top expenses, and more at a glance.

- Generate instant tax reports depending on your country’s regulations.

- Integrations with other business management tools for expanding the business.

Key Benefits for Landscapers

- One of the best tools for landscapers expanding their business.

- A suite of automated tools for saving your time and increasing efficiency.

- You can create estimates for landscaping projects and track all the costs once the project starts.

- With detailed reports, get clarity into the profitability of each landscaping project you undertake.

- Time tracking is directly billed in the invoice, saving landscapers extra effort and time.

- Mobile accessibility helps landscapers to track expenses and create invoices on the site.

Zoho: Customer Support

- Phone Support: You can contact customer support 24 hours a day, Monday to Friday, to solve your query.

- Chatting System: You can resolve your small queries through live chatting and email support.

- Online Resources: There are various online resources, like videos and blogs. Additionally, in-house codes are also available to help less-tech-savvy landscapers.

Pros and Cons

Pros

-

Best accounting software for automating repetitive work and alerts

-

Easy project management with an efficient mobile application

-

Robust customer software including phone, live chat, and email

Cons

-

Standard invoice templates, not many options

-

Cap on the number of monthly transactions

-

Inventory and project management are only available in the high-tier plan

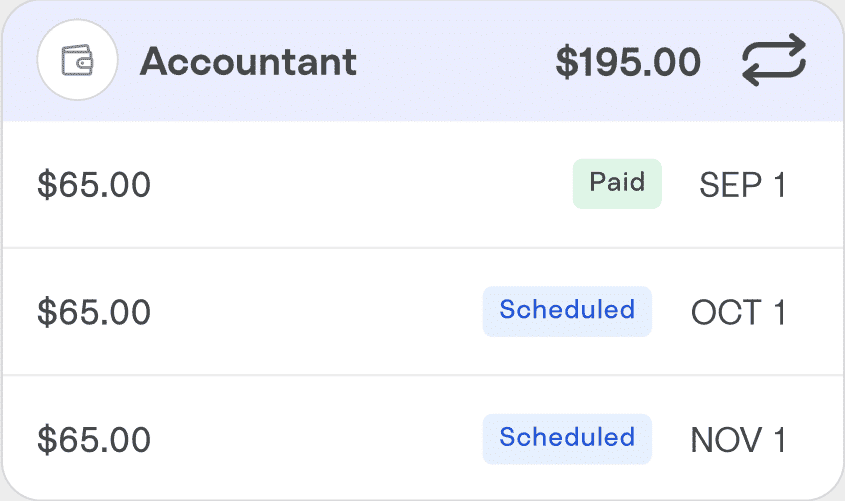

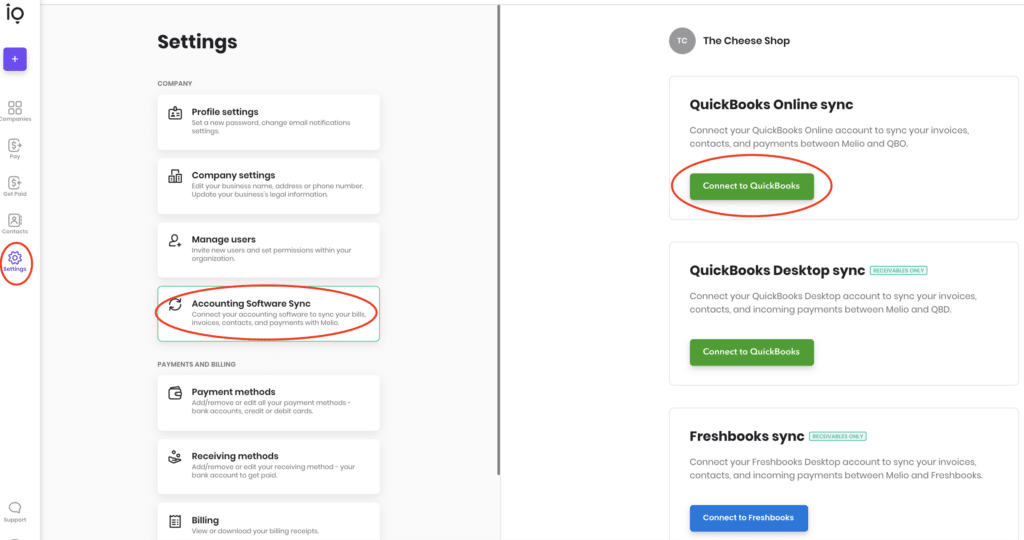

#5 Melio – Best For Small Business Payments

Melio is not a complete accounting solution, but it is one of the most effective for organizing small business payments, payables, and receivables. The service is tailor-made for small business owners, offering them accounting tools like FreshBooks and Xero to make bookkeeping easy.

A great way for landscaping businesses to manage relationships with plant nurseries, equipment suppliers, and subcontractors is significant for the day-to-day operations. Melio is responsible for making this process easier and faster with the help of an easy-to-use vendor management system. Moreover, it allows you to make payments that match your cash flow, pay vendors by credit card.

Expert score 4.1 |

Key Features

One-stop Payment Solution

- Melio offers free bank transfers, credit card payments (2.99% fee), and mailed checks (the first two are free per month).

- The platform allows landscapers to pay even if the next person prefers to receive a check. Melio can print and mail the check on your behalf.

- Melio offers 50% time savings on bill payment processes and no-cost ACH bank transfers.

- Automate your work by setting recurring payments, bills, invoices, and advanced approval workflows, and more.

- You can generate branded personalized payment links that accept debit or credit cards.

- Supports batch payments for better efficiency.

- Instant payment transfer capabilities so you don’t have to wait for payments.

Workflow Management

- Multiple integration options like Xero, FreshBooks, etc.

- Automatic receipt reading is available, saving you from manual logging.

- You can efficiently time and manage the payments to suppliers and subcontractors, helping to maintain project schedules and avoid delays.

- A handy mobile application for on-site payment requests.

- In-depth payment transactions analysis offers key insights into spending trends and outstanding payables.

Key Benefits For Landscapers

- Highly beneficial for landscapers who have problems managing their transactions.

- One of the most secure payment platforms that saves from fraud.

- Speeds up payments to suppliers and subcontractors, helping landscapers build strong vendor relationships and get better terms.

- Improves cash flow management by providing greater control over when payments are sent and received, enabling landscapers to manage their working capital better.

Melio: Customer Support

- Premium Support: Dedicated support service via phone, chat, and email.

- Informative Help Center: Melio offers a help center with FAQs, articles, and guides to answer common questions about using the platform and making payments.

Pros and Cons

Pros

-

One-stop solution for payment management and tracking

-

Prioritizes security through encryption, fraud detection, and approval workflows.

-

Vendor-friendly setup; recipients don’t need Melio accounts.

Cons

-

More payment options, but limited accounting features

-

2.99% fee for credit card payments may be high for frequent transactions.

-

International payments are limited to USD. For a flat fee of $20 USD per payment.

Top 5 Accounting Applications for Landscapers: Comparison Table

| Feature | Moss | FreshBooks | Xero | Zoho | Melio |

|---|---|---|---|---|---|

| General Accounting | ✓ | ✓ | ✓ | ✓ | ✓ |

| Core Accounting | No (Focuses on Expenses) | ✓ | ✓ | ✓ | No (Focuses on Payments) |

| Invoicing | No (Manages Expenses Related to Invoices) | ✓ | ✓ | ✓ | Facilitates Payment of Invoices |

| Expense Tracking | ✓ | ✓ | ✓ | ✓ | Manages Payment Outflow |

| Financial Reporting | Spending Reports | ✓ | ✓ | ✓ | Payment Reports |

| Landscaping-Specific Needs | ✓ | ✓ | ✓ | ✓ | ✓ |

| Job Costing | Yes (Expense Tracking) | ✓ | ✓ | ✓ | Contributes by Streamlining Payments |

| Project Management | Contributes by Tracking Project Expenses | Yes (Basic) | Yes (Basic) | Yes (Basic) | Contributes by Ensuring Timely Payments |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| On-Site Invoicing | No Direct Invoicing, Manages Related Expenses | ✓ | ✓ | ✓ | No Direct Invoicing, Facilitates Payments |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Online Payment Processing | Manages Expenses Related to Payments | ✓ | ✓ | ✓ | Core Functionality |

| Bank Reconciliation | Integrates with Accounting Software | ✓ | ✓ | ✓ | Integrates with Accounting Software |

| Corporate Cards | ✓ | No | No | No | No |

| Automated Receipt Capture | Yes (AI-Powered) | Yes (AI-Powered) | ✓ | ✓ | ✓ |

| Integrations | Integrates with Accounting Software | ✓ | ✓ | ✓ | Integrates with Accounting Software |

| User-Friendliness | Generally High | Generally High | Generally High | Varies | High |

| Scalability | Good | High | High | High | Good |

| Best For | Spend Tracking | Overall Accounting | Deeper Financial Insights | Growing Landscaping Businesses | Small Business Payments |

Without Good Accounting Software, You’re Missing Out

- Missed Expenses: Landscapers travel extensively between multiple job sites, supply vendors, and daily client meetings, making vehicle expenses one of the largest potential tax deductions in the industry. Without systematic mileage tracking, you could lose a considerable amount in legitimate tax deductions annually that would otherwise benefit your business.

A landscaper driving 20,000 business miles annually could miss out on over $4,000 in tax deductions without proper tracking—money that directly impacts your bottom line and could fund equipment upgrades or business expansion. - Equipment Depreciation and Maintenance Losses: Landscaping equipment requires a significant capital investment with valuable tax implications that are easily overlooked without proper accounting systems. Without fixed asset management, you risk missing depreciation deductions on mowers, trimmers, blowers, and larger equipment like skid steers or tractors that could substantially reduce your tax burden. Section 179 deductions allow immediate write-offs of certain equipment purchases, but require detailed documentation that basic recordkeeping often fails to maintain.

Equipment maintenance costs are fully deductible but frequently go untracked across multiple small repairs throughout the season, representing hundreds or thousands in missed deductions. - Seasonal Cash Flow Issues: Traditional accounting methods often fall short when it comes to managing the inconsistent cash flow typical in the landscaping industry. The financial highs of the warmer months are often offset by slower business during the winter, forcing landscapers to depend on high-interest credit in the off-season, which eats into their profits.

Modern tools offered by advanced accounting software can track historical trends, enabling you to set aside funds during busy periods, and suggest additional services to generate substantial off-season income.

- Unprofitable Service Offerings: Without detailed project profitability tracking, landscapers often continue offering services that actually lose money when all expenses are properly calculated. Many landscapers base pricing on competitive market rates or simple hourly calculations without accurately accounting for equipment wear, material waste, travel time between sites, or administrative overhead.

- Tax Preparation Penalties and Stress: Many landscapers face unnecessary penalties for late filing or inaccurate reporting that proper accounting systems would prevent. Disorganized financial records lead to rushed tax preparation and increase the likelihood of expensive errors or missed deductions.

Without systematic record-keeping, tax preparation typically requires days of sorting through scattered receipts, bank statements, and handwritten notes—time better spent on revenue-generating activities during the critical spring startup period. The rush often leads to conservative deduction claims, with many landscapers leaving legitimate write-offs unclaimed due to insufficient documentation.

Insight into the Financial Situation of Your Landscaping Business

Accounting software provides landscapers with critical insights that extend far beyond basic bookkeeping. For landscaping professionals, these insights can reshape business strategy and significantly improve profitability.

One of the most valuable insights comes from seasonal trend analysis. Quality accounting software allows you to see exactly how your income and expenses fluctuate throughout the year, allowing you to plan your services accordingly. You might find that while spring cleanup generates a high revenue, it is less profitable than assumed due to the labor and disposal costs associated with the service. Or that some maintenance contracts produce steady revenue with minimal expenses, and are thus ideal for financial stability.

Service profitability analysis often reveals surprising results for landscapers. Many landscapers assume that high-ticket installations, such as patios or water features, are their most profitable offerings, only to discover that it’s the recurring maintenance contracts that actually generate higher margins when factoring in equipment costs, material waste, and labor efficiency. This insight helps focus marketing efforts on your truly profitable services.

For landscapers looking to grow their business, these insights are really useful as they provide the foundation for strategic decision-making—whether that means expanding certain service lines, adjusting seasonal offerings, or restructuring client relationships.

Price Information Per Program

It’s very important for you to take into consideration the price of each accounting software when you are making your choice. The following are the details about the cost structures for each of the systems we have talked about. Prices are subject to change, so it is advisable that you visit the software provider’s website to confirm the latest information.

FreshBooks Pricing

FreshBooks uses a subscription-based model. Plans include (USD/month, with 70% off for 4 months):

| Tier | Plan |

|---|---|

| Lite | $6.30 (was $21.00) |

| Plus | $11.40 (was $38.00) – Most Popular |

| Premium | $19.50 (was $65.00) |

| Select | Contact for pricing. |

| Add-ons | Available for Advanced Payments ($20/month), Team Members ($11/person/month), and FreshBooks Payroll ($40/month plus $6/month per user). FreshBooks offers a 30-day money-back guarantee. |

Note: FreshBooks offers a 30-day free trial and a 30-day money-back guarantee.

Zoho Books Pricing

Zoho uses a subscription-based model.

Plans include:

| Tier | Plan |

|---|---|

| Standard | $15 (Offers access for up to 3 users – Send 5,000 invoices a year) |

| Professional | $40 (Offers access for up to 5 users – Send 10,000 invoices a year) |

| Premium | $60 (Offers access for up to 10 users – Send 25,000 invoices a year) |

| Elite | $120 (Offers access for up to 10 users – Send 100,000 invoices a year) |

| Ultimate | $240 (Offers access for up to 15 users – Send 100,000 invoices a year) |

| Add-ons | Available for users ($9/user/month), timesheet users ($3/user/month), advanced auto scans ($10/50 scans/month), branches ($12/branch/month), and timbres (Mex$69/100 timbres). |

Note: Zoho offers a 14-day free trial for the Standard and Premium plans. Prices are exclusive of local taxes.

Xero Pricing

Xero uses a subscription-based pricing model. Plans include (USD per month):

| Tier | Plan |

|---|---|

| Starter | Usually $29, now $2.90 for 3 months. |

| Standard | Usually $46, now $4.60 for 3 months. |

| Premium | Usually $69, now $6.90 for 3 months. |

| Add-ons | Additional costs for optional features like expenses, projects, and analytics plus may apply. |

Note: Xero offers a 30-day free trial.

Moss

Moss uses a modular pricing structure, determined by the chosen spend modules and add-ons, as well as the volume of transactions.

- Moss offers a free option for Corporate Cards (up to 3 users) and Accounts Payable (up to 20 invoices per month). Eligibility verification may be required.

- Pricing is customized by choosing spend modules (Corporate Cards, Employee Reimbursements, Accounts Payable), add-ons (Advanced Controlling, Advanced Accounting, Procurement, ERP), and transaction volume.

Melio

Melio’s pricing is primarily focused on transactions. There are generally no fees to receive payments.

- Fees may apply for certain payment methods, such as instant transfers.

When evaluating the cost of accounting software, consider not only the subscription fee but also potential additional costs, such as:

- Fees for extra users

- Add-ons or integrations

- Transaction fees

- Support costs (if applicable)

It’s also a good idea to take advantage of free trials to test the software and see if it meets your needs before committing to a paid plan.

| Product |

|

|

|

|

|

|---|---|---|---|---|---|

| Learn more | >>>Learn More | >>>LearnMore | >>>Learn More | >>>Learn More | >>>Learn More |

| Free trail period | 30 days | 30 days | 30 days | 14 days | 30 days |

| Starting price | Free | $6.30 p/month | $2.90 p/month | $10 p/month | $19 p/month |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Integration options | ✓ | ✓ | ✓ | ✓ | ✓ |

| Rating | 4.7 / 5 | 4.5 / 5 | 4.3 / 5 | 4.2 / 5 | 4.1 / 5 |

Frequently asked questions

Accounting software is an essential tool using which landscapers can track job costs, seasonal income, equipment expenses, and mileage between sites while maximizing tax deductions. Most landscapers save 5-10 hours weekly on administrative tasks, time that can be redirected to billable work.

The software provides daily financial control and real-time insights into cash flow—critical for seasonal businesses—while an accountant offers strategic tax planning on a quarterly basis. Most accountants prefer clients who use quality accounting software since it provides cleaner data and reduces the time consumed on basic bookkeeping.

Landscapers can use accounting software to perform job costing and quickly identify their most profitable services and project types. It also provides seasonal planning tools that are helpful in managing the cash flow fluctuations typical in landscaping. Equipment management features track machinery costs and depreciation for better purchase decisions. Time tracking streamlines crew payroll while revealing labor efficiency across different job types. Mobile capabilities allow invoicing and expense tracking directly from client sites, reducing administrative friction.

Starting with accounting as a landscaper with a limited financial background is completely manageable with the right approach. You should begin by selecting a user-friendly software designed for service businesses—FreshBooks and Zoho Books are particularly accessible for accounting newcomers. Take advantage of free trials and focus first on mastering the basics: invoicing clients, tracking expenses, and reconciling bank transactions. Start with core functions and gradually expand your usage as your comfort with the system grows.

Related articles

Best Accounting Software For Plumbers

Boost your plumbing business’s financial health. Explore top accounting software for easy invoicing, expense control, and data-driven growth.

Best Accounting Software For Painters

Discover the best accounting solutions for painters with detailed reviews of FreshBooks, Zoho, Xero, Melio, and Moss. Save time on bookkeeping and focus on your painting business.

Best Accounting Software for Beauty Salons

Find the perfect accounting software for your beauty salon and discover specialized features to boost your beauty salon’s profitability and growth.

Mark Rosbergen

Expert business software

About Software Pointer

Softwarepointer.com is a platform that was created from a lot of passion for the accountancy profession. Founder Mark Rosbergen started the platform with aim of helping people with their entrepreneurial questions, especially in the field of accounting. With more dan 20 years of experience in accountancy, entrepreneurs are helped every day tot move forward with their business. How? Offering solutions for all entrepreneurial issues in the form of comparison tools, templates, rich articles and tops! We help your company move forward.