As a Self-employed bar owner, managing multiple operations and at the same time monitoring the financial part, such as the cost of goods sold, liquor inventory, and sales, is not an easy task. Doing the business and the manual bookkeeping at the same time could drive you crazy, and your business might s

Doing administrative work costs you precious time and vitality that could be invested in better services and customer satisfaction. Additionally, handling too many things at the same time could cause mistakes and sometimes blunders.

Sound financial and operational management heavily depends on your choice of accounting software. Advanced accounting software can help you make informed, data-driven decisions that protect your bar from financial or operational hiccups that could ruin your years of hard work.

We have tested over 20+ accounting software and picked the top 5 ideal for self-employed bar owners. The following accounting software were chosen based on their features, pricing, and usability to help you find a long-term solution that will help you streamline your financial management.

Our best tested picks

- Xero – Best For Growing Financial Needs

- Zoho Books – Best For Automating Business Operations

- FreshBooks – Best For Simple and All-round bookkeeping

- Moss – Best For Accurate Cost Tracking and Management

- Melio – Best For Robust Payment Service

These Are The Best Accounting Programs For Bars

Bar owners have more operational tasks, such as inventory management, marketing, staff management, and bookkeeping, including sales, purchase orders, and expenses. These programs are chosen after a detailed analysis of a bar’s needs.

Here is our detailed selection criteria while selecting these programs:

- Inventory Management and POS: The most important area of management for a bar owner is inventory. During busy hours, if your stock runs out, it could cause financial harm and damage to customer relationships. A robust inventory management tool will help you keep track of each item so you never disappoint your customers.

- Core Financial Capabilities: Tracking expenses, sales, and cash flow is non-negotiable in any business. Without accurate bookkeeping, you won’t be able to track your profitability and areas of improvement. These software will provide various automation features to track sales and expenses.

- Ease of Use: Other than the main features, an easy-to-use interface matters a lot to someone who doesn’t have much time to spend. Complex interfaces require a higher learning curve and are prone to mistakes. That’s why ease of use has been one of our priorities when selecting the software.

- Mobile accessibility: When choosing the right accounting software, a handy mobile application is necessary. You cannot bring your laptop or system everywhere, but with a mobile application, you can instantly handle things like an invoice or a receipt.

- Integrations: Some programs excel at particular features, like inventory management or POS, but lack others. That is why online integrations are important for managing all tasks in one place. This software provides easy online integrations with top accounting programs.

- Pricing: All these programs offer different membership tiers for self-employed individuals and enterprises. We have carefully checked the pricing structure of this software and will give a detailed description later in this article.

- Customer Support: When setting up your program or facing demand in season, you might encounter issues; customer support quality can make or break your experience. These software offers multiple support channels, including phone, email, chat, and comprehensive knowledge bases tailored to service-based businesses.

Top 5 Accounting Programs for Bars

Each of the following software programs has been carefully examined to meet the needs of a bar. From their primary use cases to small features, we’ve tried to cover everything so you can make an informed investment in your accounting software.

- Xero: Best For Growing Financial Needs

- Zoho Books: Best For Automating Business Operations

- FreshBooks: Best For Simple and All-round bookkeeping

- Moss: Best For Accurate Cost Tracking and Management

- Melio: Best For Robust Payment Service

#1 Xero – Best For Growing Financial Needs

Xero is a cloud-based accounting platform known for its detailed financial features that could turn around your financial game. The platform provides over 50 reports with detailed analysis of key metrics like profit, loss, sales, expenses, cash flow, amount payable, and receivables. Bars can track each and every movement of the cash that goes in and out of the business.

Additionally, Xero provides other essential features, such as inventory management, invoices, multiple payment options, and AI automation, to save time and reduce manual work. For additional features, you can integrate the software with multiple business software applications.

Expert score 4.7 |

Key Features

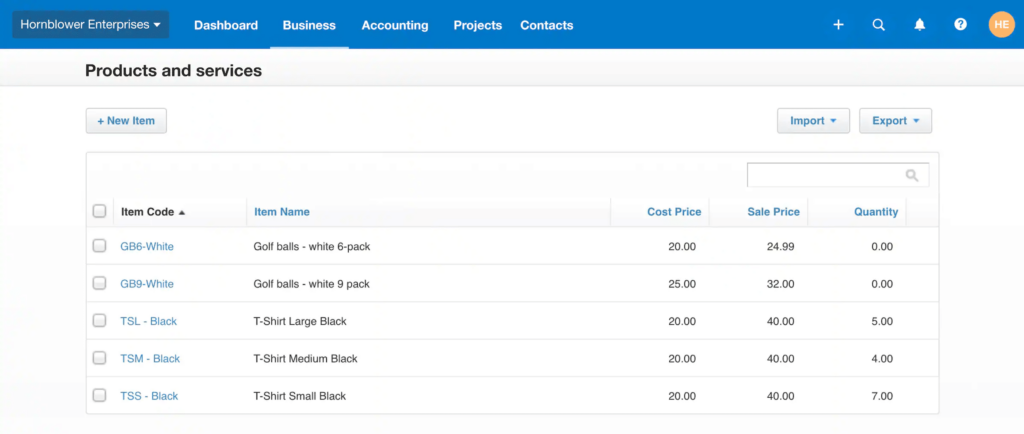

Inventory Management

- To manage liquors, mixers, garnishes, and food items, there are over 4,000 finished items options.

- You can track stock levels with Xero’s inventory in real-time.

- Check your best-selling item and restock once it hits the threshold level.

- An inventory performance report helps to increase profitability significantly.

- You can add items you buy and sell to invoices and purchase orders.

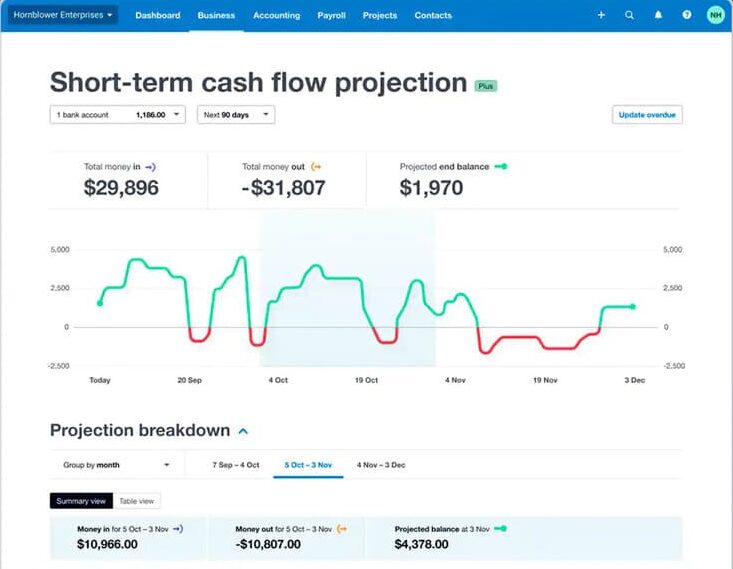

Cash Flow Management

- Xero provides advanced cash flow management tools to track each and every cash activity.

- You will get automated alerts when your cash flow hits specific thresholds.

- You can analyze future cash flow positions with Xero’s cash flow forecast tool, which helps with seasonal and occasional demand.

- Track real-time receivables and scheduled payments to know your cash positions.

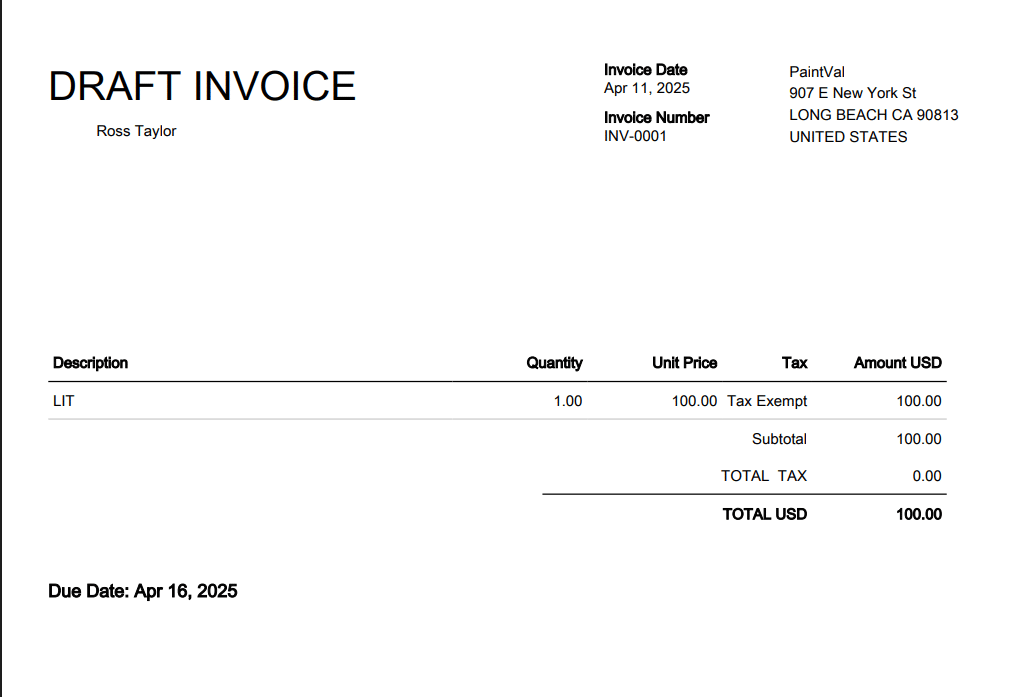

Bookkeeping

- You can create customizable invoices instantly after the service.

- Payment links are embedded in the invoice to help you get paid faster.

- Link your bank with the software to import data straight from your bank.

- You can track all the products used and time spent on each service to track costs efficiently.

- Log expenses with one snapshot of receipts, which will be categorized automatically.

- Bank reconciliation helps you keep records up to date and saves you from errors.

Payroll Integration and Analytics

- You can automate recurring payroll to save time and manual work.

- To pay, enter details like employees’ hours, hourly rates, taxes, and deductions, and the software will manage the payroll with small edits.

- Xero records all the payroll details online and reconciles wage payments.

- Detailed analytical reports show your business’s health and areas of improvement.

- A simple dashboard shows costs, profit margin, and QoQ and YoY revenue and profit.

- For tax filing, Xero automatically creates sales tax on transactions.

- Tax return filing is very easy because of Xero’s automated tax reports.

Integrations

- Xero allows integration with more than 1,000 third-party apps.

- You can integrate your program with other software for specific needs like Gusto for advanced payroll management.

- Easily try apps before committing to subscriptions, and easily integrate with Xero’s app store.

Key Benefits For Bars

- Real-time inventory management tools so you don’t fall short for your highest-selling product, like liquors.

- Know your future cash flow position to prepare for any event beforehand.

- Customize invoices with your bar’s logo and brand, creating a professional image for customers.

- No payment is delayed as customers can pay directly through the invoice link.

- Detailed expense tracking, so you can know which services and products you are losing money on.

- Profit loss, and tax reports save you hassle at the time of tax filing.

Xero: Customer Support

- Xero Central: Xero has created a dedicated online web page that provides information on various issues.

- No phone support: Xero does not offer phone support for customers, which is a limitation. In case of any problem or query, you can only reach out via email support.

Pros and Cons

Pros

-

Xero provides a user-friendly interface for easy navigation

-

Real-time inventory management with 4,000+ finished stocks

-

Cash flow forecast tool and bank integration, automated expense record

Cons

-

Limited features in entry-level plans

-

Fewer invoice customization options as compared to competitors

-

Limited customer service channels

#2 Zoho Books – Best for Automated Business Operations

Zoho Books is one of the top tools in the entire Zoho Suite. It provides an ideal solution for self-employed bar owners who are expanding their operations with multiple revenue streams and want to automate simple tasks like expense tracking and recurring invoices.

The wide integration options within the Zoho Suite are one of the biggest advantages for businesses. You can integrate advanced tools like Zoho Inventory for efficient inventory management within Zoho Books. Additionally, you can manage foreign transactions and international payments with the multi-currency feature.

Expert score 4.5 |

Key Features

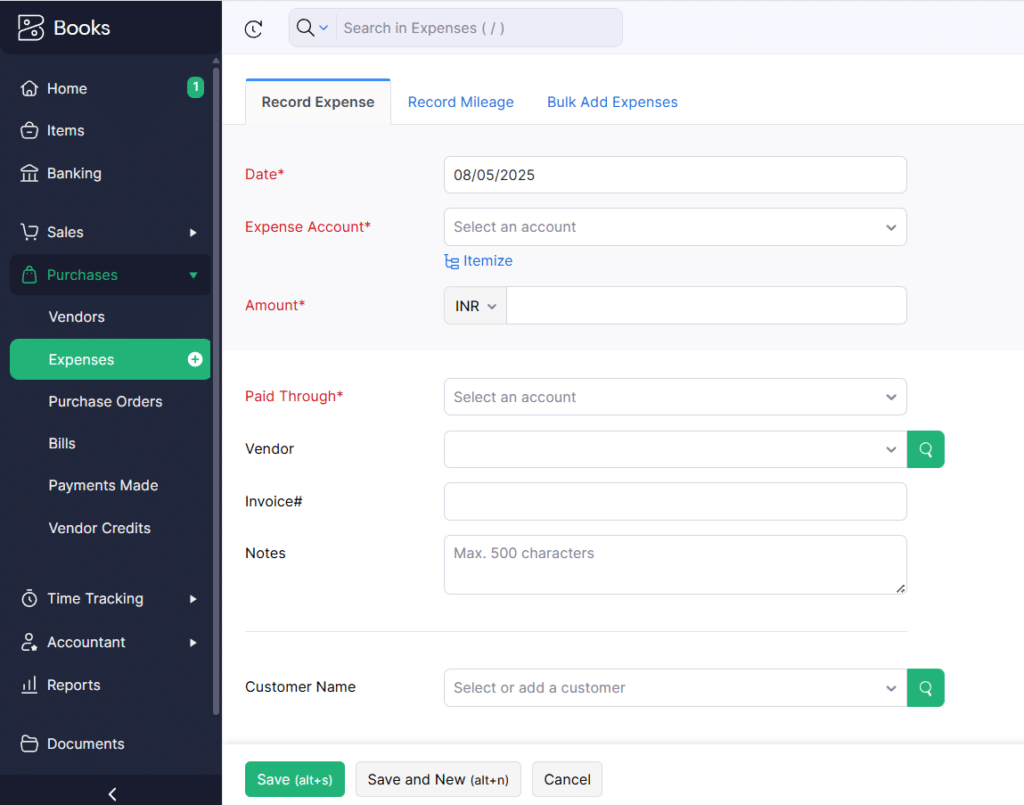

Automation

- Xero allows invoices to be automated for recurring clients, which is perfect for events or corporate clients.

- Easy workflow automation with defined rules and conditions to trigger actions like email alerts or field updates.

- You can set automated payment reminders for outstanding balances.

- Zoho sends alerts for events like restocking inventory or customer comments.

- You can automatically convert quotes to invoices and create bills from purchase orders.

- Automatic expense logging and categorization from a single snapshot.

- You can also automate recurring expenses that take place regularly.

Branded Invoicing and Cash Flow Management

- Create branded invoices with logo and brand slogans with multiple category options.

- You can integrate payment links on the invoice to get paid faster.

- Convert quotes into invoices for specific event-based services.

- You can optimize your payment receivables and payables process for consistent cash flow management.

- Diverse payment options, both domestic and international.

Expense and Inventory Management

- Zoho Inventory integrations provide advanced inventory tools for better management.

- You can manage products according to SKUs, images, and vendor details.

- Inventory alerts help you keep your stocks above a threshold level so you are never short of supplies.

- You can track time accurately with Zoho’s time tracker.

- With the OCR feature, log expenses through a single snapshot.

Financial Reports

- An analytical dashboard lets you see receivables, payables, inventory, and more in easy charts.

- To improve pain points, you can check profit loss, profit margin, and total expenses in reports.

- Zoho allows you to generate a tax report according to your country’s regulations.

- You can generate specific reports for more than one bar by associating a tag with relevant transactions.

- The mobile application is available for instant operations.

Integrations

- Zoho Books offers several integration options within the Zoho ecosystem.

- Third-party integrations are also possible through Zoho Books’ open API and Webhooks.

- Zoho offers appropriate integrations to meet specific needs, such as client management and payroll.

Key Benefits for Bars

- Bars can create professional invoices and automate them for recurring clients.

- Diverse payment options and direct payment through the invoice link.

- Robust cash flow and inventory management with automated remainders.

- Time tracking is directly billed in the invoice, saving you extra effort and time.

- You can choose any tool from the Zoho suite and easily integrate with Zoho Books, like Zoho Inventory, for advanced inventory management.

Zoho: Customer Support

- Customer Support: Zoho’s customer support is available from 9:00 AM to 5:00 PM on business days to solve your query.

- Chatting System: You can resolve your small queries through live chatting and email support.

- Online Resources: Zoho provides comprehensive knowledge bases, such as videos, FAQs, and blogs.

Pros and Cons

Pros

-

Automation helps to save time and manual work

-

Wide integration options within and outside the Zoho ecosystem

-

Customizable invoicing and international payment options

Cons

-

Additional costs for more users

-

Workflow automation may face some glitches

-

Integrations are not available on the free plan

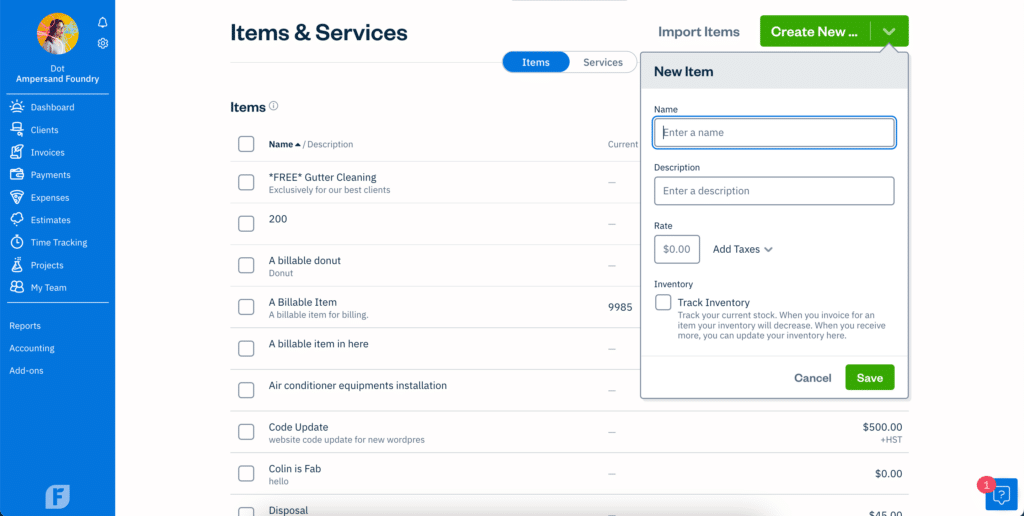

#3 FreshBooks – Best For Simple and All-round bookkeeping

Bars looking for specific features around bookkeeping may find FreshBooks the best option because of its most accessible accounting tools, which can be used even by someone with very little accounting experience. FreshBooks provides essential accounting features with an intuitive and simple interface.

The platform provides various tools for accurate spend tracking that can free you from manual entry in Excel. FreshBooks allows users to log expenses through a smartphone with a camera photo. Additionally, the Customer support at FreshBooks is exceptional, with phone support available Monday through Friday from 8 am to 8 pm.

Expert score 4.3 |

Key Features

Invoicing

- FreshBooks provides customizable invoice options with a brand logo and company name.

- You can choose from different customizable options for the invoice.

- You can automate recurring digital invoices, and users can easily include discounts.

- You will get automatic alerts whenever a customer receives or views an invoice.

- The FreshBooks invoice generator lets you add your tracked time and expenses easily.

- Direct payment from the invoice can be initiated with embedded links.

Inventory Management

- You can add, edit, and review inventory for billable items within your account.

- When you generate an invoice, the item is automatically reduced from inventory.

- Real-time tracking on inventory so you can avoid overstocking or running out of high-demand products.

- FreshBooks allows you to track your fixed assets.

- You can efficiently manage inventory by generating insightful inventory reports, such as stock levels and value.

Expense Tracking

- You can directly log your expenses by connecting your bank and credit cards to the program.

- With mobile receipt scanning, you can log expenses from a photo.

- FreshBooks’ time tracker allows you to track hours spent on services.

- You can mark expenses as billable, add a markup, and automatically add them to client invoices.

Integrations

- You can integrate FreshBooks with over 100 third-party apps.

- You can use Acuity Scheduling to schedule events.

- The FreshBooks payroll feature allows you to pay your team from the app without wasting time.

- You can access the full report of your previous payroll runs with hours & earnings for your team.

Reports

- A detailed tax report is automatically generated according to the business.

- FreshBooks’ payroll automatically deducts tax, so you don’t have to hassle at the time of reporting.

- You can conveniently access important reports like profit and loss to learn about your business’s health.

- A detailed financial report tells you where you are losing money or if there is any extra spending.

Payment

- Automatic recording and invoice matching save your time.

- Multiple payment options like PayPal, Apple Pay, and bank transfers.

- ACH connects to most major banks in the U.S.

- Post Checkout Links on your website and socials.

Key Benefits for Bars

- Bars can generate a branded invoice with their logo and company name.

- Real-time inventory management doesn’t let your best-selling product run out.

- Automated features like OCR can reduce manual work and save time.

- Bars can analyze their performance with a detailed report and improve with key data.

- Diverse payment options for vendors create a strong relationship.

FreshBooks Customer Support

- Dedicated Support Staff Assistance: FreshBooks’ support team has a high rating in the public reviews on Trustpilot- 4.8/5.0. You can contact FreshBooks Support services through phone, email, and chat.

- Comprehensive Knowledge Base: FreshBooks provides an online knowledge base and webinars, offering users information and self-service support options.

Pros and Cons

Pros

-

One-stop accounting solution with a simple interface

-

Wide integrations and robust inventory management

-

24/7 customer support options for platform help

Cons

-

The mobile app has limited functionalities

-

No multi-currency option in invoicing

-

Few custom reporting options

#4 Moss – Best For Accurate Cost Tracking and Management

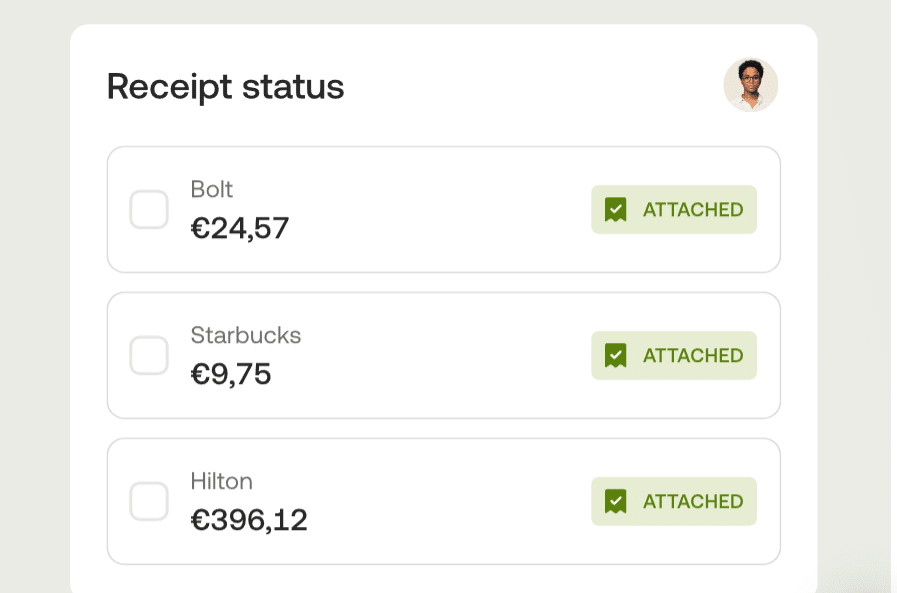

Moss is a cloud-based accounting platform that specializes in accurate spend management. The platform allows bar owners to issue virtual and physical cards to trusted employees with customizable spending limits and category restrictions. This reduces waste spending and keeps track of every cost that occurs in running the business.

Moss provides various automated features to track spending by integrating AI tools. You can upload data from card transactions, supplier invoices, and employee reimbursements, which saves you valuable time and saves you from manual work. Additionally, the platform saves a lot of time for bars on the month-end process.

Expert score 4.2 |

Key Features

Advanced Spend Tracking

- Categorize all bills to visualize cash flow to alcohol orders, vendor payments, and miscellaneous expenses.

- Moss processes snapshots of invoices with OCR and sends automatic reminders to employees to upload receipts in time.

- Smart AI automations handle the input of each transaction into accounting fields.

- With Moss, you can track and manage employee expenses in real-time.

- Automatic expense reconciliation replaces manual bookkeeping, saving time and reducing human errors.

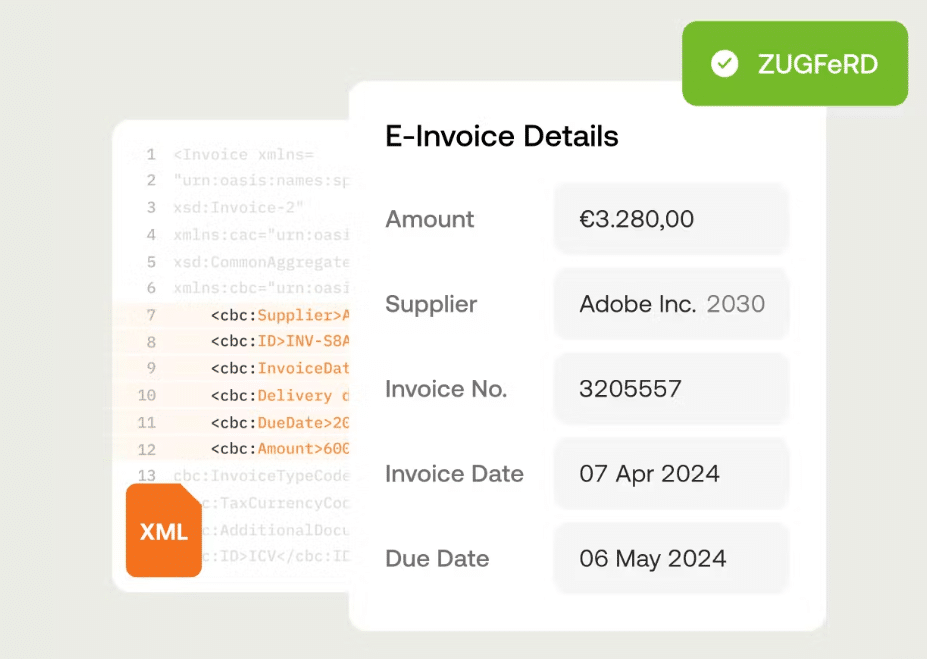

Invoices and Payments

- Track the status of all invoices – pending, approved, partially paid, or fully paid.

- Automatically extract data from uploaded receipts and invoices, reducing manual entry.

- You can set up custom rules for invoice approvals based on the invoice value, location, and vendor type.

- Schedule payments directly from Moss after invoice approval.

- Moss supports batch payments, allowing you to pay multiple invoices at once.

Multiple Integration Options

- Moss allows you to connect with leading software such as Xero, Microsoft Business Central, Oracle, etc.

- Two-way syncing keeps the master data updated across integrated software.

- Get full control over what and when to sync, with exports available via API or CSV.

Key Benefits For Bars

- Bars can issue physical or virtual cards to bar managers, bartenders, or supervisors, eliminating cash handling and missing expenses.

- Track expected future expenses to plan inventory restocking and staff rescheduling.

- Get instant alerts when spending nears or exceeds budget limits.

- Owners can manage multiple bars or venues from one centralized dashboard.

Moss: Customer Support

- Onboarding Support: Moss provides personalized support to all businesses during onboarding to cater to customer-specific needs.

- Customer Support: Moss’s customer service is available via phone or email from Monday to Friday between 9 a.m. and 4 p.m. It also has a 24/7 self-service portal that includes guides, troubleshooting articles, and setup tutorials.

Pros and Cons

Pros

-

All-in-one payment solution, both domestic and international

-

Cash flow management through an automated workflow

-

Simple user interface and no monthly fees

Cons

-

Payment-focused software needs integrations for bookkeeping

-

No CRM integration option available

-

International payments are limited to USD. For a flat fee of $20 USD per payment.

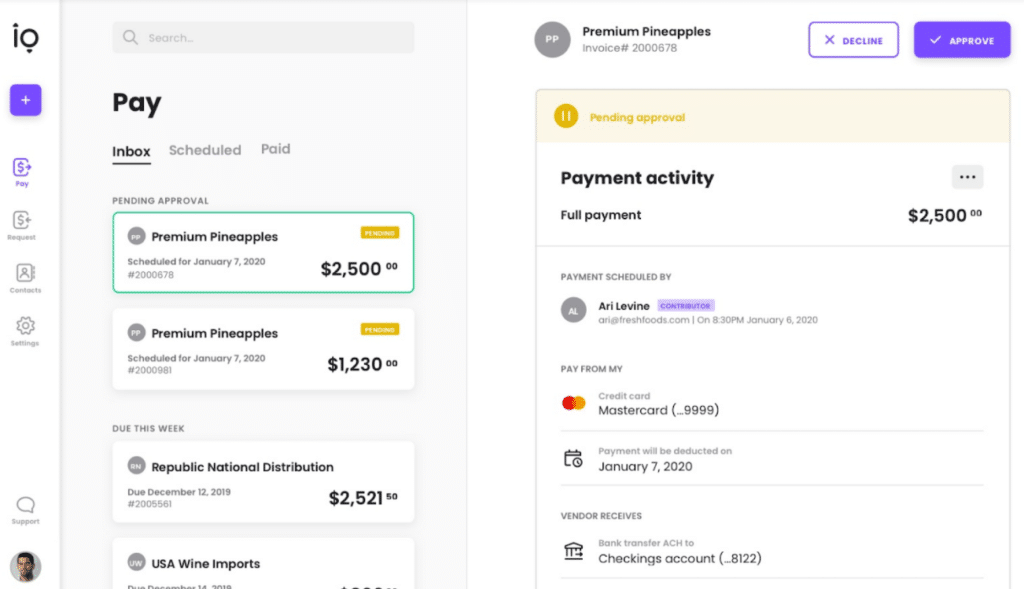

#5 Melio – Best For Robust Payment Service

Melio is a cloud-based end-to-end payment solution that boosts efficiency and offers a streamlined approach to bill payments. It is not a complete accounting solution in itself, but with software like FreshBooks and Xero, it becomes a top solution for bars.

Bars encounter cash flow management issues due to inconsistent revenue streams, delayed vendor payments, and seasonal demand fluctuations. Melio’s integration and incredible tools offer bar owners an intuitive way to manage their payment workflows. Moreover, it allows you to make payments that match your cash flow and pay vendors by credit card.

Expert score 4.1 |

Key Features

Cash Flow Management

- Melio offers no-cost ACH bank transfers and provides 50% time savings on bill payment processes.

- It enables businesses to make payments to suppliers via bank transfer or debit card. If they prefer to receive a check, you can also print and mail the check on your business’s behalf.

- Payments can be made via ACH for free, credit card for a 2.9% fee, or paper checks for $1.50 each.

- Melio has multi-currency payment options with instant transfer capabilities, so you don’t have to wait to receive payments.

Project Management

- Easy integration with multiple accounting software, like Xero and FreshBooks.

- When you upload a picture of your receipt, it automatically adds invoices to your expense records.

- Offers a convenient mobile application to convert on-site payment requests quickly.

- It helps manage and time the payments to suppliers, helping you maintain schedules and avoid payment delays.

- Easy tax filing with detailed reports on your business’s income and expenditure.

Key Benefits For Bars

- Melio is one of the most secure payment solutions, so you don’t have to worry about payment fraud.

- With Melio, bars can collect payments from customers without barriers, as it makes it convenient for customers to pay through multiple simple online payment options.

- Melio improves cash flow management by providing you control over when payments are sent and received, enabling bar owners to manage their capital more effectively.

- “Pay Over Time” features enable you to better maintain your cash flow, helping you maintain strong relationships with suppliers by making payments upfront.

Melio: Customer Support

- Informative Help Center: Melio provides a detailed help center with FAQs, articles, and guides to address common queries about platform usage and payment-making.

- Direct Email Support Channel: Devoted chat and email support service, where you can receive immediate assistance and get urgent issues resolved.

Pros and Cons

Pros

-

Comprehensive payment tracking and bill management features

-

Moss automates data entry for tasks like accounts payable, saving time and reducing manual effort

-

24/7 customer support options for platform help

Cons

-

Payment-centric features but lacks accounting functionalities.

-

Charges a flat $20 fee for any International payment.

-

Fewer integration options compared to other accounting programs.

Top 5 Accounting Applications for Bars: Comparison Table

| Feature | Xero | Zoho Books | FreshBooks | Moss | Melio |

|---|---|---|---|---|---|

| General Accounting | ✓ | ✓ | ✓ | ✓ | ✓ |

| Core Accounting | ✓ | ✓ | ✓ | No (Focuses on Expenses) | No (Focuses on Payments) |

| Invoicing | ✓ | ✓ | ✓ | No (Manages Expenses Related to Invoices) | Facilitates Payment of Invoices |

| Expense Tracking | ✓ | ✓ | ✓ | ✓ | Manages Payment Outflow |

| Financial Reporting | ✓ | ✓ | ✓ | Spending Reports | Payment Reports |

| Bars-Specific Needs | ✓ | ✓ | ✓ | ✓ | ✓ |

| Job Costing | ✓ | ✓ | ✓ | Yes (Expense Tracking) | Contributes by Streamlining Payments |

| Project Management | Yes (Basic) | Yes (Basic) | Yes (Basic) | Contributes by Tracking Project Expenses | Contributes by Ensuring Timely Payments |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| On-Site Invoicing | ✓ | ✓ | ✓ | No Direct Invoicing, Manages Related Expenses | No Direct Invoicing, Facilitates Payments |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Online Payment Processing | ✓ | ✓ | ✓ | Manages Expenses Related to Payments | Core Functionality |

| Bank Reconciliation | ✓ | ✓ | ✓ | Integrates with Accounting Software | Integrates with Accounting Software |

| Corporate Cards | No | No | No | ✓ | No |

| Automated Receipt Capture | ✓ | ✓ | Yes (AI-Powered) | Yes (AI-Powered) | ✓ |

| Integrations | ✓ | ✓ | ✓ | Integrates with Accounting Software | Integrates with Accounting Software |

| User-Friendliness | Generally High | Varies | Generally High | Generally High | High |

| Scalability | High | High | High | Good | Good |

| Best For | Growing Financial Needs | Automating Business Operations | Simple and All-round bookkeeping | Expense Management | Payment Processing |

Without Good Accounting Software, You’re Missing Out

Inadequate accounting practices are not just an administrative headache; they also directly impact the bottom line and business sustainability. Without proper financial management tools designed for your salon business’s unique needs, you’re likely leaving money on the table in several ways.

Profitability: For self-employed bar owners, inadequate accounting practices aren’t just an administrative headache—it can seriously hurt your profits and long-term business sustainability. Without proper financial software, there’s a good chance you’re missing out on money in a bunch of important areas.

Inventory Management: On average, bars lose around 23% of potential profits to overpours, theft, and wastage. Inventory shrinkage is a major concern in the bar industry, and without proper tracking systems, these losses slip by unnoticed. The right accounting software with inventory integration can highlight discrepancies between purchases, sales, and physical stock, allowing you to catch the problem early and fix it quickly.

Cash Flow Management: Managing cash flow is tough for bars. Revenue tends to spike on weekends and drop during slower seasons, but vendors are to be paid on time regardless of sales performance. Without accounting software that can give you clear cash flow projections, it’s easy to miss out on early payment discounts—or worse, rack up interest charges and late fees, which eat into your profits more than you might think.

Tax Compliance and Deductions: Taxes are another area where bar owners often leave money on the table. The hospitality industry has many possible write-offs, from obvious expenses like inventory and equipment to less apparent deductions like certain renovation costs, staff meals, and professional development. Without good accounting software, it’s easy to miss these and end up overpaying.

Insight into the Financial Situation of Your Bar

Quality accounting software transforms raw financial data into actionable business intelligence that can dramatically boost your bar’s performance and profitability.

One critical insight that bar owners gain is product profitability analysis. While you might intuitively know which drinks are popular, accounting software can help you find the ones that actually generate the highest profit margins. For example, your craft cocktail menu might drive significant revenue, but after accounting for ingredient costs, preparation time, and waste, you might discover that your draft beer program delivers superior profit margins despite lower per-unit prices.

Seasonal trend analysis is another valuable perspective. Proper financial tracking helps find patterns in customer spending, allowing you to improve inventory purchasing, staffing, and promotional activities.

Vendor relationship optimization becomes possible with comprehensive financial data. Analyzing payment histories and purchase patterns enables you to negotiate better terms, take advantage of volume discounts, and consolidate orders to minimize delivery fees. Over time, the benefits from these small optimizations compound to boost your profitability.

Price Information Per Program

It’s very important for you to take into consideration the price of each accounting software when you are making your choice. The following are the details about the cost structures for each of the systems we have talked about. Prices are subject to change, so it is advisable that you visit the software provider’s website to confirm the latest information.

Xero pricing

Xero uses a subscription-based pricing model. Plans include (USD per month):

| Tier | Plan |

|---|---|

| Starter | Usually $29, now $2.90 for 3 months. |

| Standard | Usually $46, now $4.60 for 3 months. |

| Premium | Usually $69, now $6.90 for 3 months. |

| Add-ons | Additional costs for optional features like expenses, projects, and analytics plus may apply. |

Note: Xero offers a 30-day free trial.

Zoho Books pricing

Zoho uses a subscription-based model.

Plans include:

| Tier | Plan |

|---|---|

| Standard | $15 (Offers access for up to 3 users – Send 5,000 invoices a year) |

| Professional | $40 (Offers access for up to 5 users – Send 10,000 invoices a year) |

| Premium | $60 (Offers access for up to 10 users – Send 25,000 invoices a year) |

| Elite | $120 (Offers access for up to 10 users – Send 100,000 invoices a year) |

| Ultimate | $240 (Offers access for up to 15 users – Send 100,000 invoices a year) |

| Add-ons | Available for users ($9/user/month), timesheet users ($3/user/month), advanced auto scans ($10/50 scans/month), branches ($12/branch/month), and timbres (Mex$69/100 timbres). |

Note: Zoho offers a 14-day free trial for the Standard and Premium plans. Prices are exclusive of local taxes.

FreshBooks Pricing

FreshBooks uses a subscription-based model. Plans include (USD/month, with 70% off for 4 months):

| Tier | Plan |

|---|---|

| Lite | $6.30 (was $21.00) |

| Plus | $11.40 (was $38.00) – Most Popular |

| Premium | $19.50 (was $65.00) |

| Select | Contact for pricing. |

| Add-ons | Available for Advanced Payments ($20/month), Team Members ($11/person/month), and FreshBooks Payroll ($40/month plus $6/month per user). FreshBooks offers a 30-day money-back guarantee. |

Note: FreshBooks offers a 30-day free trial and a 30-day money-back guarantee.

Moss pricing

Moss uses a modular pricing structure, determined by the chosen spend modules and add-ons, as well as the volume of transactions.

- Moss offers a free option for Corporate Cards (up to 3 users) and Accounts Payable (up to 20 invoices per month). Eligibility verification may be required.

- Pricing is customized by choosing spend modules (Corporate Cards, Employee Reimbursements, Accounts Payable), add-ons (Advanced Controlling, Advanced Accounting, Procurement, ERP), and transaction volume.

Melio pricing

Melio’s pricing is primarily focused on transactions. There are generally no fees to receive payments.

- Fees may apply for certain payment methods, such as instant transfers.

When evaluating the cost of accounting software, consider not only the subscription fee but also potential additional costs, such as:

- Fees for extra users

- Add-ons or integrations

- Transaction fees

- Support costs (if applicable)

It’s also a good idea to take advantage of free trials to test the software and see if it meets your needs before committing to a paid plan.

Frequently asked questions

Yes, accounting software is pretty important for bar owners who want to run a successful business. Bars deal with a high volume of transactions, complex inventory, varying profit margins depending on products, and a lot of cash handling. In the early days, spreadsheets might suffice for basic tasks, but dedicated software becomes necessary once things pick up.

Most bar owners spend 5–10 hours a week on manual data entry and keeping up with their finances. The right software can save you that time, which you could use to improve your customer experience or try out new ideas for your menu or events.

Working with an accountant is definitely useful for proper tax planning and compliance, but depending only on them without using the right software isn’t recommended. For one, you’ll probably be paying them to do simple data entry tasks that software could easily handle—and it’ll cost you way more per hour. Also, accountants provide financial insights only during periodic meetings, which is not efficient. Using software allows you to access the financial information of your business whenever you need.

Specialized accounting software is not only useful for basic bookkeeping, but also addresses the peculiar challenges of running a bar. The inventory management feature tracks the cost of liquor, beer, wine, and mixers, helping you identify waste and theft that impact your profit margins. POS integration helps save time by automatically categorizing sales by product type, eliminating hours of manual data entry.

Choose a user-friendly software specifically designed for non-accountants. Connect your business bank accounts and credit cards to import transactions automatically, greatly minimizing the need for manual data entry. Start by performing simple tasks such as organizing business expenses into inventory, utilities, rent, and payroll. Practice the basic operations and gradually move to more advanced features like profitability analysis and inventory tracking.

Making the Right Choice for Your Bar

All five options we’ve reviewed offer excellent features. Your selection should be based on your specific needs, because choosing the right accounting software greatly impacts your business’s financial health and workload.

Setting up the right accounting system will pay dividends through improved financial visibility, simplified tax compliance, and strategic insights, helping your bar thrive in a competitive market.

Xero strikes a good balance between comprehensive features, inventory management, and POS integration, making it our top recommendation for most self-employed bar owners. Large establishments with multiple income sources could benefit more from Zoho Books’ project tracking capabilities. On the other hand, smaller operations might prefer FreshBooks for its ease of use.

All of these platforms offer free trials, so you can play around with their features and see what feels right before committing. Getting proper accounting software in place is one of the most important decisions you can make to turn your bar from just a passion project into a sustainable and profitable business.

| Product |

|

|

|

|

|

|---|---|---|---|---|---|

| Learn more | >>> Learn More | >>> Learn More | >>> Learn More | >>> Learn More | >>> Learn More |

| Free trail period | 30 days | 14 days | 30 days | 30 days | 30 days |

| Starting price | $2.90 p/month | $10 p/month | $6.30 p/month | Free | $19 p/month |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Integration options | ✓ | ✓ | ✓ | ✓ | ✓ |

| Rating | 4.7 / 5 | 4.5 / 5 | 4.3 / 5 | 4.2 / 5 | 4.1 / 5 |

Related articles

Best Accounting Software For Plumbers

Boost your plumbing business’s financial health. Explore top accounting software for easy invoicing, expense control, and data-driven growth.

Best Accounting Software for Retailers

Looking for the best accounting software for your Retail business? Compare top accounting solutions with features designed to help retailers save time and maximize profits.

Best Accounting Software for Landscapers

Discover the best accounting software for landscapers to track seasonal income, manage equipment costs, and maximize tax deductions while spending more time in the field and less on paperwork

Mark Rosbergen

Expert business software

About Software Pointer

Softwarepointer.com is a platform that was created from a lot of passion for the accountancy profession. Founder Mark Rosbergen started the platform with aim of helping people with their entrepreneurial questions, especially in the field of accounting. With more dan 20 years of experience in accountancy, entrepreneurs are helped every day tot move forward with their business. How? Offering solutions for all entrepreneurial issues in the form of comparison tools, templates, rich articles and tops! We help your company move forward.