Nowadays, every growing industry and business requires expert advice and guidance to solve problems and achieve goals, and that is why the need for consultants is continuously increasing. Consultants analyze clients’ different needs to develop recommendations or solutions.

Amid this busy work, efficient accounting software is a secret weapon that keeps your finances and accounting in shape. It not only saves time and manual work, but you also become worry-free with automated and accurate tracking of your finances.

Your choice of accounting software can greatly impact your operations by simplifying administrative tasks in a single place. There are hundreds of options, which can confuse you and waste your time. But you don’t have to worry; we have taken a deep dive into you and have selected the top 5 accounting software for consultants.

We will discuss their features, pricing, fees, and reputations to give consultations the best accounting software.

Our best tested picks

- FreshBooks – Best All-Around Solution for Consultants

- Xero – Best for Consultants with Growing Financial Needs

- Zoho Books – Best for Consultants with Specific Needs

- Moss – Best for Consultants with Expense Management Needs

- Melio – Best for Consultants with Complex Accounts Payable

These Are The Best Accounting Programs For Consultants

Consultancy jobs require sheer focus and problem-solving ability, these accounting software will save your energy and time. Some of these software are designed as all-in-one accounting solutions, while others need some integrations and focus on specific areas like payment and cost tracking.

Here is our detailed selection criteria while selecting these programs:

- Accurate Financials: Keeping an accurate record of your financials is crucial to understanding your financial position on the job. Maintaining detailed records of income, expenses, and assets is also crucial for tax preparation, financial reporting, and cash flow management.

- Ease of Use: As a consultant, your hours are packed with brainstorming and finding solutions, and you don’t want to spend hours navigating the program. Complex interfaces require a higher learning curve and are prone to mistakes. That’s why ease of use has been one of our priorities when selecting the software.

- Accurate Time Tracking: Consulting projects today are billed by the hour. Most of the software listed below features time tracking tools to assist consultants in monitoring every minute, ultimately enhancing profitability.

- Integrations and Mobile Accessibility: With over 100 third-party integrations, you can add specific software features to enhance your accounting efficiency. Additionally, all these software provide mobile applications to use features like invoicing, logging expenses, and reporting from your mobile device.

- Pricing: All these programs offer different membership tiers for self-employed individuals and enterprises. We have carefully checked the pricing structure of this software and will give a detailed description later in this article. Additionally, you can reach customer support with different channels, including phone, email, chat, and comprehensive knowledge bases tailored to service-based businesses.

Top 5 Accounting Programs for Consultants

We’ve done a detailed deep dive into the following software. From their primary use cases to small features, we’ve tried to cover everything so you can make an informed investment in your accounting software.

- FreshBooks – Best All-Around Solution for Consultants

- Xero – Best for Consultants with Growing Financial Needs

- Zoho Books – Best for Consultants with Specific Needs

- Moss – Best for Consultants with Expense Management Needs

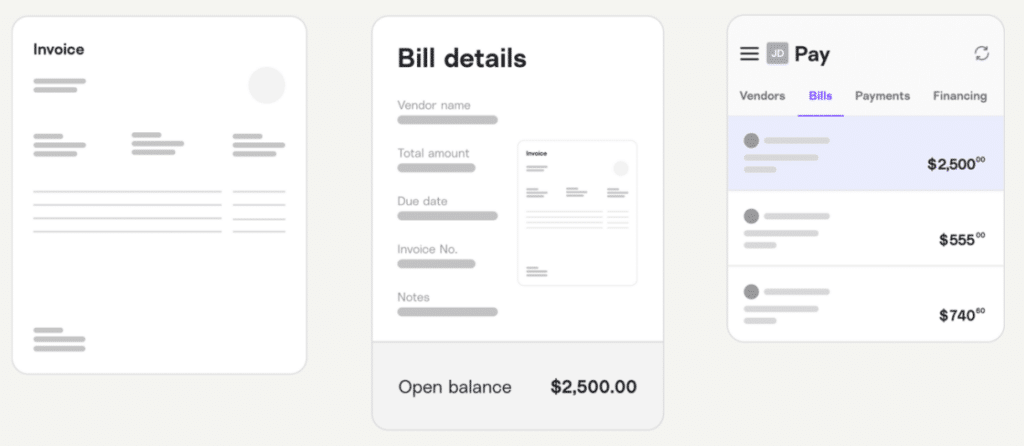

- Melio – Best for Consultants with Complex Accounts Payable

#1 FreshBooks – Best All-Around Solution for Consultants

FreshBooks has been our top choice as an all-in-one accounting solution for consultants. The platform provides a simple interface that even a beginner can navigate swiftly. FreshBooks contains an array of features for consultants like project and client management, tracking time, customizable invoicing, and payments.

Expert score 4.7 |

FreshBooks allows various third-party integrations, which makes the platform more attractive to those who need details about specific features. Additionally, the software is highly suitable for multiple client management with features like a client portal, project collaboration tools, and client-specific reporting.

Key Features

Client Management

- You can keep track of clients in one place with all the info on expenses, invoices, and payments.

- With the client portal, you can engage with the client and keep them updated and informed about the project.

- Clients can make comments and share files via the client portal.

- FreshBooks provides detailed client reports with revenue, expenses, and time entries, which help you analyze which client contributes more to your success.

- The platform also tracks the client’s remaining credits.

Invoicing

- FreshBooks provides professional and customizable invoices so that you can create a professional image in front of the client.

- You can ask for a deposit on the invoice upfront to cover expenses.

- Invoices can be automated for recurring clients.

- You can receive direct payments through invoices by adding a link to the invoice itself.

- You can monitor every activity of the invoice when the customer receives or views it, and create an invoice immediately on the mobile application.

Expenses

- FreshBooks allows you to connect to your bank and credit card to automate expense logging.

- You can scan a receipt with your phone camera and email it to save all the details.

- Expenses will be automatically categorized, keeping the tax in mind.

- With FreshBooks, you can quickly mark your expenses as billable, add a markup, and then automatically pull them onto an invoice for your client.

- Real-time and accurate time tracking for accurate invoicing, ensuring you get paid for every billable hour.

Payments and Integrations

- FreshBooks provides multiple payment options like credit cards, Apple Pay, and bank transfers.

- ACH connects to most major banks in the U.S.

- Automatic recording and invoice matching save you time when processing month-ends.

- Set an automatic reminder for payables and late payments.

- FreshBooks offers multiple CRM integration options, including HubSpot, Capsule CRM, and Nocrm.io.

Reports

- FreshBooks has a very useful dashboard and reports to see how your company is doing.

- Profit and loss reports that are accurate will help you spot the areas that need improvement in the financial performance.

- The annual and quarterly financial reports will not only be your time savers but also bring you peace of mind during the tax season.

Key Benefits for Consultants

- FreshBooks’ fully functional and less overwhelming platform helps consultants navigate easily.

- Accurate expense and time tracking help consultants track every billable minute.

- Consultants can save a lot of time by directly connecting your bank and credit card accounts.

- Branded invoices help consultants to present themselves professionally.

- No issues with payments with FreshBooks’ multiple payment options.

- Consultants can integrate the software with multiple CRM programs for dedicated client management features.

FreshBooks Customer Support

- Dedicated Support Staff Assistance: FreshBooks’ support team has a high rating in the public reviews on Trustpilot- 4.8/5.0. You can contact FreshBooks Support services through phone, email, and chat.

- Comprehensive Knowledge Base: FreshBooks provides an online knowledge base and webinars, offering users information and self-service support options.

Pros and Cons

Pros

-

Professional and customizable invoices that can be automated

-

Robust project management features are ideal for consultants

-

Accurate time tracking and invoice catch-up

Cons

-

No batch-invoicing shortcuts.

-

The mobile application doesn’t give access to reports

-

Limited scalability, but fit for the self-employed

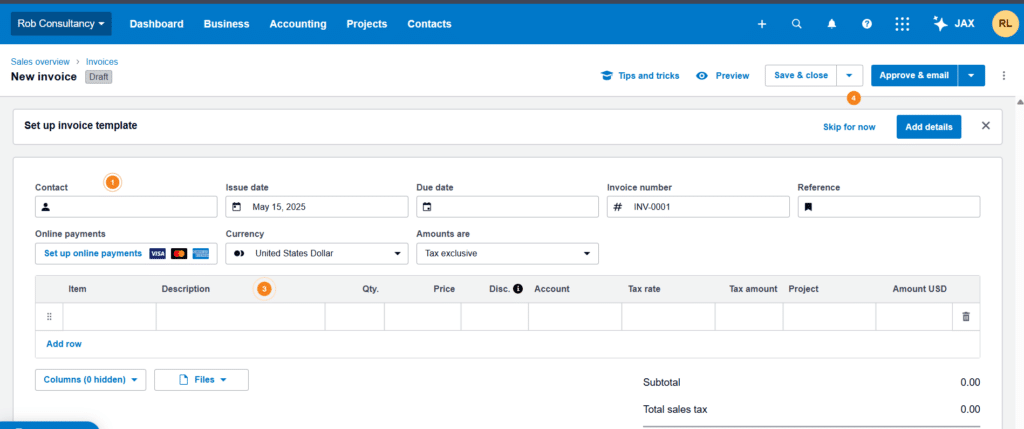

#2 Xero – Best for Consultants with Growing Financial Needs

Xero is a cloud-based accounting solution for consultants with growing financial needs. The platform provides a simple dashboard that provides a clear view of project status and financials. The program’s tracking functionality is excellent for consultants, allowing you to monitor time, costs, and profitability for each client engagement.

For consultants who are expanding their service and hiring staff, they can accommodate unlimited users at no additional cost. Additionally, you can integrate Xero with over 800 third-party apps, which makes it highly adaptable to your specific workflow needs as your needs grow.

Expert score 4.5 |

Key Features

CashFlow Management

- Xero provides real-time cash flow management that helps users to stay ahead of their finances.

- Automated remainders on cash receivables and

- You can connect your bank with the software for an accurate view of your cash flow.

- The standout feature for cash flow management is the forecasting tool, which lets you forecast cash flow according to season, demand, and past records.

- Automated alerts when your cash flow dips below a specific threshold.

Invoicing

- You can generate professional invoices instantly after the service.

- Xero has instant quote and budget generation capability.

- Direct payment from the invoice through the embedded payment link.

- You can automate recurring invoices for regular clients and set automatic reminders for payments.

Project Tracking

- Xero includes time tracking in all its plans, which is a crucial tool for consultants.

- Expenses can be automatically fetched from the bank account after linking with the program.

- You just have to click a single photo of the receipts to log expenses and categorize them automatically.

- Bank reconciliation features help find transactions and keep records error-free.

Payments

- Using trusted payment services, you can accept payments through credit and debit cards, direct debit cards, and more.

- In-person payment on the spot via the Xero Accounting App.

- You can automate payment by ACH Direct Debit with GoCardless.

- Xero has robust security protections and strong encryption.

Integrations and Reports

- Xero provides 1,000+ third-party integrations, with many CRM integrations, including HubSpot, Capsule, and Prospect.

- Xero provides tracking of depreciation on your assets, saving time for taxes.

- The profitability dashboard provides a detailed view of your financial condition, including a profit and loss statement.

- You can monitor the breakdown of costs, including areas that need improvement.

- Tax reports that show tax obligations can be obtained using Xero.

Key Benefits For Consultants

- With Xero’s advanced tools, such as cash flow forecasts and real-time tracking, consultants will never run short on cash.

- Automated scheduling and alerts for pending receivables help consultants get paid faster.

- Professional quotations and invoicing help consultants present professional services.

- Xero’s mobile application generates on-site invoices, quotes, and reports, helping you close the deal immediately.

Xero: Customer Support

- Live Support: Xero does not offer phone support to its customers, which is a notable limitation. If you have any problems or queries, please contact the support via email or live chat.

- Xero Central: Xero has created a dedicated online webpage that provides information on various topics.

- AI Support: Xero is introducing JAX (Just Ask Xero), a generative AI customer service assistant for simple queries.

Pros and Cons

Pros

-

Real-time cash flow tracking and forecasting

-

Unlimited user count without additional cost

-

More than 1,000 integrations and bank reconciliation

Cons

-

No phone support, hard to reach customer support live

-

Less attractive invoice customization features

-

An entry-level plan limits bills and other features

#3 Zoho Books – Best for Consultants with Wider Needs

Zoho Books is one of the top choices for consultants who want to automate various tasks with automated tools and their own scripting language to code custom functions. The major benefit for consultants using Zoho Books is the wide range of integration within the Zoho Suite, like Zoho CRM, Zoho Projects, etc. Zoho Suite can cover all the needs of a self-employed consultant.

Additionally, Zoho is known for its simple interface and ability to provide analytics in a simple format. For project management, Zoho’s client portal has impressed incredibly, which makes it easy for customers to view their invoices and pay their bills online.

Expert score 4.3 |

Key Features

Task Automation

- You can create workflow rules for various automated tasks.

- Zoho Books allows you to automate payment email reminders and send messages that go out at specific intervals.

- You can automatically convert accepted quotes into invoices.

- Tech-savvy consultants can create customized automation tools.

Client Management

- Zoho Bools allows an easy integration with Zoho CRM, which is a top client management tool.

- A dedicated client portal helps you to connect with clients, as customers can view their invoices and pay their bills online.

- This portal also allows you to chat with customers safely.

- You will automatically be notified when the customer receives or views invoices or bills.

Invoicing

- Zoho provides one of the best customized invoicing features, allowing you to embed your brand logo and slogan on the invoice.

- You can directly bill the client for the time tracked and ask for approval for the same.

- For regular clients, you can set up recurring invoices and enter credit memos for customers.

- Payments can be directly accepted through a link on the invoice.

Streamline Receivables

- Faster payments with instant invoice generation from phone or tablet.

- Multi-currency and multilingual invoicing for foreign clients.

- Partially invoice your quotes with custom amounts for each line item so your cash flow remains balanced.

- Paid invoices get marked as paid as soon as customers pay you.

- You can track and categorize expenses and bill your customer accordingly from a single place.

Reporting and Integrations

- You can create an automated data report for key matrices like receivables, profit, expenses, etc.

- Zoho Books allows you to generate crucial reports at any time.

- With the reporting tag, you can know which of your services are giving you more benefits.

- Zoho Books lets you generate tax reports depending on your country’s regulations.

Key Benefits For Consultants

- Consultants can save their precious time and eliminate manual work through various task automations.

- Dedicated client management tools help consultants to better connect with clients.

- Instant professional invoice generation and multi-currency payment options help consultants to get paid faster.

- Zoho Books is one of the top programs for specific integrations with the help of the Zoho Suite.

- Detailed reporting helps consultants know their financial condition and areas of improvement.

Zoho Books: Customer Support

- Chatting System: You can resolve your small queries through live chatting and email support.

- Phone Support: You can contact customer support from 5 AM to 6 PM hours a day, Monday to Friday, to solve your query.

- Guides and code: There are various online resources, like videos and blogs. Additionally, in-house codes are also available to help less tech-savvy consultants.

Pros and Cons

Pros

-

Robust automated functions, including custom codes

-

Customizable invoicing option and multi-currency payments

-

Zoho allows various integrations within Zoho Suites and third-party applications

Cons

-

For specific automation coding abilities are required

-

A cap on the number of monthly transactions

-

Automated features and integration are not available on the free plan

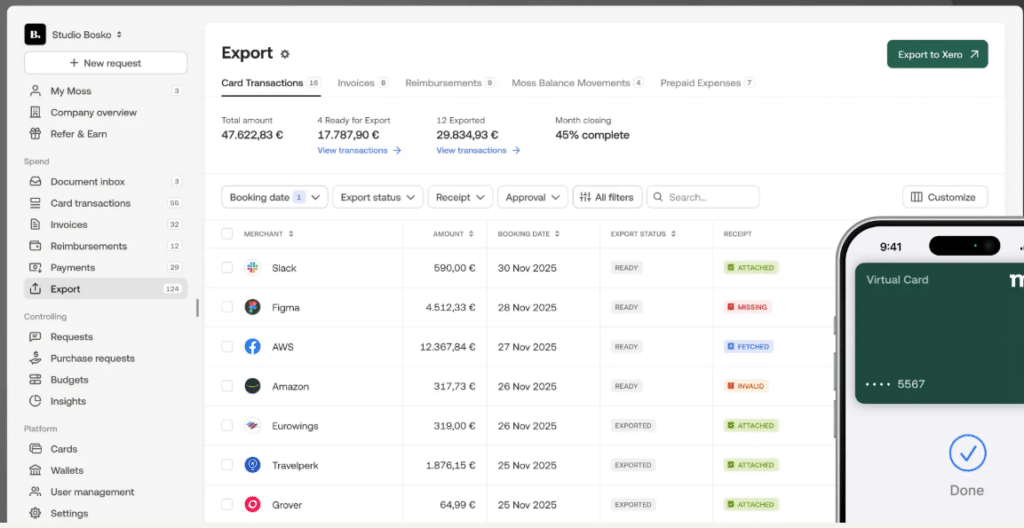

#4 Moss – Best for Consultants with Expense Management Needs

Moss is a cloud-based expense management platform that automates financial tracking, simplifying expense tracking and revenue calculation for consultants. It simplifies how you handle payments and expenses — whether traveling for a client meeting, purchasing software tools, or reimbursing subcontractors, with Moss, you can stay on top of business expenses.

Expert score 4.2 |

Moss is designed to meet the demands of modern consultants who want to stay efficient and financially organized.

Key Features

Smart Spending

- You can scan receipts using your phone, and Moss automatically reconciles and links them to the respective client or project.

- Moss automatically logs expenses in the system from receipts and transactions, minimizing manual entry.

- You can issue virtual and physical credit cards from Moss with a fixed budget.

- Every transaction from cards, invoices, and reimbursements is logged and reconciled automatically.

- Moss provides live spending tracking across different projects.

Payments

- Send instant and secure payments across the EU, UK, and beyond via SEPA or local banking systems.

- Supports multiple currencies, helping consultants work with international clients and collaborators with ease.

- Download transaction histories filtered by projects anytime for easier reconciliations.

- Offers cashback on high-volume card transactions to recover some business spending.

Integrations

- Moss automatically collects invoice data through e-invoicing and executes direct payments via Moss or a bank.

- Two-way integration with major accounting platforms, such as Xero, QuickBooks, DATEV, and SAP, keeps your record books updated.

- Automatically syncs data, saving time during monthly closings or while preparing tax documents.

Key Benefits For Consultants

- You can categorize expenses based on clients or projects for more accurate reporting and easier billing.

- While traveling or working remotely, consultants can use the Moss app to capture expenses and approve payments.

- Cost tracking can help you control wasteful spending and increase profitability.

- Real-time expense tracking and automated policy enforcement ensure compliance with tax requirements.

Moss: Customer Support

- Customer Support: Support representatives are available by phone or email from Monday to Friday, 9 a.m. to 4 p.m.

- Help Center: Users can find solutions to common issues using detailed articles on Moss’s help center.

- Onboarding Support: Moss’s dedicated onboarding support staff helps set up the software according to your consulting business.

Pros and Cons

Pros

-

Multi-currency and international payments support.

-

Seamless integration with top accounting tools.

-

Automated, AI-driven expense tracking.

Cons

-

Requires external tools for time tracking and invoice generation.

-

Full feature access comes at a higher price tier.

-

No built-in CRM or client portal.

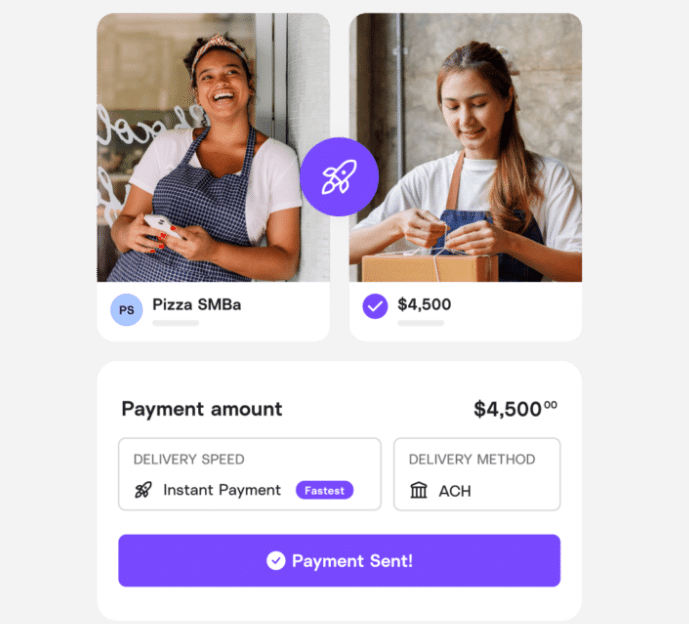

#5 Melio – Best for Consultants with Complex Accounts Payable

Melio is an end-to-end product that provides payment solutions to consultants to help them manage their finances more efficiently. It can be integrated with Xero and FreshBooks to create a full-fledged accounting system, making it ideal for solo consultants who face unpredictable cash flow due to delayed client payments, project-based billing, and variable monthly income.

Expert score 4.1 |

Key Features

Payment Solutions

- Supports multi-currency payments and facilitates instant international transfers, helping consultants who work with global clients get paid faster.

- Offers no-cost ACH bank transfers, saving up to 50% of the time typically spent on manual bill payments at reduced transaction costs.

- It allows ACH, debit, or credit card payments, and even if the recipient only accepts checks, Melio will mail the check for you.

- Melio payments via ACH are free, credit card payments come at a tiny 2.9% fee, and a fixed $1.50 per check transfer.

Workflow Management

- It can easily be integrated with multiple accounting platforms like FreshBooks and Xero, streamlining financial management.

- Melio offers a user-friendly mobile platform that is handy for consultants working on the go who need to approve or make payment requests on site.

- Helps track payments to contractors and software vendors, helping manage project schedules and avoid missed deadlines.

- With Melio, you can perform in-depth analysis of payment transactions to gain insights into spending trends.

- Provides downloadable reports that simplify tax filing and monitor expenses.

Key Benefits for Consultants

- Melio is one of the most secure payment solutions that removes worries about payment fraud, allowing consultants to focus on their work.

- Highly secure and flexible online payment methods make collecting fees on time from international clients easy, so you don’t have to chase invoices.

- Melio lets you schedule payments based on project timelines and expected income, helping you avoid cash shortages between projects.

- With branded invoices and payment methods, consultants can maintain a professional image, helping build clients’ trust.

Melio: Customer Support

- Direct Support: Melio offers quick phone, email, and chat support to help you resolve issues without delay.

- Informative Help Center: Melio’s comprehensive help center includes FAQs, tutorials, and step-by-step guides for common queries, from accounting software integrations to managing payments.

Pros and Cons

Pros

-

Clients can make payments without signing up for a Melio account

-

Make international transactions in over 80 countries

-

No monthly fees

Cons

-

Lacks built-in accounting features, as it is a payments-focused software

-

Charges a flat $20 fee for each international transfer

-

Customer support is primarily online, which may not suffice in urgent or high-stakes situations.

Top 5 Accounting Applications for Consultants: Comparison Table

| Feature | FreshBooks | Xero | Zoho | Melio | Moss |

|---|---|---|---|---|---|

| General Accounting | ✓ | ✓ | ✓ | ✓ | ✓ |

| Core Accounting | ✓ | ✓ | ✓ | No (Focuses on Payments) | No (Focuses on Expenses) |

| Invoicing | ✓ | ✓ | ✓ | Facilitates Payment of Invoices | No (Manages Expenses Related to Invoices) |

| Expense Tracking | ✓ | ✓ | ✓ | Manages Payment Outflow | ✓ |

| Financial Reporting | ✓ | ✓ | ✓ | Payment Reports | Spending Reports |

| Consultancy-Specific Needs | ✓ | ✓ | ✓ | ✓ | ✓ |

| Job Costing | ✓ | ✓ | ✓ | Contributes by Streamlining Payments | Yes (Expense Tracking) |

| Project Management | Yes (Basic) | Yes (Basic) | Yes (Basic) | Contributes by Ensuring Timely Payments | Contributes by Tracking Project Expenses |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| On-Site Invoicing | ✓ | ✓ | ✓ | No Direct Invoicing, Facilitates Payments | No Direct Invoicing, Manages Related Expenses |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Online Payment Processing | ✓ | ✓ | ✓ | Core Functionality | Manages Expenses Related to Payments |

| Bank Reconciliation | ✓ | ✓ | ✓ | Integrates with Accounting Software | Integrates with Accounting Software |

| Corporate Cards | No | No | No | No | ✓ |

| Automated Receipt Capture | Yes (AI-Powered) | ✓ | ✓ | ✓ | Yes (AI-Powered) |

| Integrations | ✓ | ✓ | ✓ | Integrates with Accounting Software | Integrates with Accounting Software |

| User-Friendliness | Generally High | Generally High | Varies | High | Generally High |

| Scalability | High | High | High | Good | Good |

| Best For | All-Around Solution for Consultants | Consultants with Growing Financial Needs | Consultants with Specific Needs | Consultants with Complex Accounts Payable | Consultants with Expense Management Needs |

Without Good Accounting Software, You’re Missing Out

Inadequate accounting practices can cause considerable financial leakage that has a direct effect on your bottom line as a consultant. Without proper financial management tools, you risk:

- Unbilled hours slipping through the cracks: Consultants often work additional unrecorded and unbilled time. Even small increments—15 minutes here, 30 minutes there—can add up to thousands in lost revenue annually.

- Missed tax deductions: Self-employed consultants are eligible for numerous business deductions that substantially reduce tax burden. Without a systematic expense tracking tool, you’re likely overlooking legitimate deductions for home office expenses, professional development, subscriptions, and travel costs.

- Cash flow constraints: Without proper software and a lack of understanding about upcoming expenses and outstanding invoices, you may face unexpected cash shortfalls. Urgent financial needs can force consultants to accept less favorable project terms hastily.

- Risk of errors in financial records: Manual accounting can lead to errors in data entry, calculations, and record-keeping, giving rise to inaccurate financial reports, wrong tax filings, and sometimes even legal issues. Poor record-keeping can also make it harder to stay tax-compliant, which may lead to expensive penalties.

- Reporting: Clients expect consultants to accurately communicate the commissions earned, expenses incurred, and payments made. Your credibility depends on accurate financial reporting, and without professional accounting tools, it is easy to make errors or face delays, risking weakening your clients’ trust.

Insight into the Financial Situation of Your Consulting Business

Robust accounting software transforms your financial data into actionable business intelligence that can guide strategic decisions for your consultancy. Comprehensive accounting tools can help you gain visibility into which services generate the highest profit margins.

Accounting software also reveals client profitability patterns that are not immediately obvious. You might find that services to your largest client actually generate lower profits due to scope creep and payment delays, while smaller clients with straightforward projects provide better returns for your time investment.

As a consultant, understanding these patterns is crucial for your sustainable growth. Rather than simply pursuing more clients or higher revenue, you can make informed decisions about which types of projects to accept, which services to promote, and how to structure your pricing models for optimal profitability.

Price Information Per Program

It’s very important for you to take into consideration the price of each accounting software when you are making your choice. The following are the details about the cost structures for each of the systems we have talked about. Prices are subject to change, so it is advisable that you visit the software provider’s website to confirm the latest information.

FreshBooks Pricing

FreshBooks uses a subscription-based model. Plans include (USD/month, with 70% off for 4 months):

| Tier | Plan |

|---|---|

| Lite | $6.30 (was $21.00) |

| Plus | $11.40 (was $38.00) – Most Popular |

| Premium | $19.50 (was $65.00) |

| Select | Contact for pricing. |

| Add-ons | Available for Advanced Payments ($20/month), Team Members ($11/person/month), and FreshBooks Payroll ($40/month plus $6/month per user). FreshBooks offers a 30-day money-back guarantee. |

Note: FreshBooks offers a 30-day free trial and a 30-day money-back guarantee.

Xero Pricing

Xero uses a subscription-based pricing model. Plans include (USD per month):

| Tier | Plan |

|---|---|

| Starter | Usually $29, now $2.90 for 3 months. |

| Standard | Usually $46, now $4.60 for 3 months. |

| Premium | Usually $69, now $6.90 for 3 months. |

| Add-ons | Additional costs for optional features like expenses, projects, and analytics plus may apply. |

Note: Xero offers a 30-day free trial.

Zoho Books Pricing

Zoho uses a subscription-based model.

Plans include:

| Tier | Plan |

|---|---|

| Standard | $15 (Offers access for up to 3 users – Send 5,000 invoices a year) |

| Professional | $40 (Offers access for up to 5 users – Send 10,000 invoices a year) |

| Premium | $60 (Offers access for up to 10 users – Send 25,000 invoices a year) |

| Elite | $120 (Offers access for up to 10 users – Send 100,000 invoices a year) |

| Ultimate | $240 (Offers access for up to 15 users – Send 100,000 invoices a year) |

| Add-ons | Available for users ($9/user/month), timesheet users ($3/user/month), advanced auto scans ($10/50 scans/month), branches ($12/branch/month), and timbres (Mex$69/100 timbres). |

Note: Zoho offers a 14-day free trial for the Standard and Premium plans. Prices are exclusive of local taxes.

Moss

Moss uses a modular pricing structure, determined by the chosen spend modules and add-ons, as well as the volume of transactions.

- Moss offers a free option for Corporate Cards (up to 3 users) and Accounts Payable (up to 20 invoices per month). Eligibility verification may be required.

- Pricing is customized by choosing spend modules (Corporate Cards, Employee Reimbursements, Accounts Payable), add-ons (Advanced Controlling, Advanced Accounting, Procurement, ERP), and transaction volume.

Melio

Melio’s pricing is primarily focused on transactions. There are generally no fees to receive payments.

- Fees may apply for certain payment methods, such as instant transfers.

When evaluating the cost of accounting software, consider not only the subscription fee but also potential additional costs, such as:

- Fees for extra users

- Add-ons or integrations

- Transaction fees

- Support costs (if applicable)

It’s also a good idea to take advantage of free trials to test the software and see if it meets your needs before committing to a paid plan.

| Product |

|

|

|

|

|

|---|---|---|---|---|---|

| Learn more | >>> Learn More | >>> Learn More | >>> Learn More | >>> Learn More | >>> Learn More |

| Free trail period | 30 days | 14 days | 30 days | 30 days | 30 days |

| Starting price | $6.30 p/month | $10 p/month | $2.90 p/month | Free | $19 p/month |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Integration options | ✓ | ✓ | ✓ | ✓ | ✓ |

| Rating | 4.7 / 5 | 4.5 / 5 | 4.3 / 5 | 4.2 / 5 | 4.1 / 5 |

Frequently Asked Questions

Yes, dedicated accounting software is a must for consultants. Most people start with spreadsheets, but this approach to financial management is not sustainable for a growing practice. Accounting software saves time by automating invoice generation, expense categorization, and financial reporting, allowing consultants to concentrate more on the client’s needs.

Accountants and accounting software go hand-in-hand, rather than being mutually exclusive, and you should work with both for an optimal accounting solution. Modern accounting software reduces the time your accountant needs to spend on basic bookkeeping, potentially lowering hiring expenses and improving financial oversight. Many accountants prefer clients who use modern accounting platforms, as they streamline collaboration and minimize errors.

Accounting software addresses several pain points for consultants:

Time tracking and billable hours: Consultants often charge on an hourly basis or need to track time against retainers. Accounting software with integrated time tracking features helps you capture billable time accurately and can convert it into invoices, ensuring you don’t lose even a second.

Project profitability: Understanding which types of consulting engagements generate the highest margins is vital for business growth. Accounting software allows you to track both direct and indirect costs against project revenue.

Professional invoicing: As a consultant, your invoices reflect your brand. Professionally made invoices with clear payment terms and multiple payment options improve your client experience and can accelerate payments.

Tax preparation: Consultants face complex tax situations due to home office deductions, business travel, and various expense categories. Proper categorization of all expenses throughout the year simplifies tax preparation.

Beyond these functional benefits, good accounting software provides peace of mind. You’ll be certain that all of your financial records are accurate, compliant, and readily available should you face a tax audit or need financial documentation for business loans or other purposes.

Start by identifying your most immediate pain points in financial management. Are you struggling with invoicing, expense tracking, or perhaps understanding your profitability? Choose software that is specifically designed to solve these challenges.

Most accounting solutions provide setup guides, video tutorials, and support teams to help you through the initial configuration phase. For the first few weeks, commit to spending just 15-30 minutes daily on financial management until it becomes routine.

Related articles

Best Accounting Software For Plumbers

Boost your plumbing business’s financial health. Explore top accounting software for easy invoicing, expense control, and data-driven growth.

Best Accounting Software For Painters

Discover the best accounting solutions for painters with detailed reviews of FreshBooks, Zoho, Xero, Melio, and Moss. Save time on bookkeeping and focus on your painting business.

Best Accounting Software for Landscapers

Discover the best accounting software for landscapers to track seasonal income, manage equipment costs, and maximize tax deductions while spending more time in the field and less on paperwork

Mark Rosbergen

Expert business software

About Software Pointer

Softwarepointer.com is a platform that was created from a lot of passion for the accountancy profession. Founder Mark Rosbergen started the platform with aim of helping people with their entrepreneurial questions, especially in the field of accounting. With more dan 20 years of experience in accountancy, entrepreneurs are helped every day tot move forward with their business. How? Offering solutions for all entrepreneurial issues in the form of comparison tools, templates, rich articles and tops! We help your company move forward.