Salespeople are the front-line warriors of a product, service, or company. Sales is not easy and requires lengthy processes and follow-ups with client management and reporting. For better reach, scalability, and growth, salespeople have to handle many responsibilities, and managing the administrative part could be too much for a self-employed sales agent.

Administrative jobs like making, keeping track of payments, payment updates, sales and expense tracking, etc., could gradually accumulate and become really difficult. Also, these tasks consume your important hours and exhaust your energy, which could be used towards lead generation and better client management.

An advanced accounting software with features like CRM, bookkeeping, and reporting could be an ideal solution for your job. We have tested over 20+ accounting software and have picked the top 5, which are ideal for self-employed sales agents/reps. We’ll compare features, pricing, and usability to help you find a long-term solution that will help you streamline your financial management.

Our best tested picks

- Zoho CRM – Best For Client Management and Sales Reporting

- FreshBooks – Best For Overall Accounting For Sales Agents

- Xero – Best for Deeper Financial Insights

- Moss – Best Spend Tracking Solution for Sales Agents

- Melio – Best For Payments

These Are The Best Accounting Programs For Sales Agents/Reps

Sales jobs require specific administrative skills that differ from other service-based jobs. These programs are chosen after a detailed analysis according to a sales agent’s needs. Some of these software are designed as all-in-one accounting solutions, while others need some integrations and focus on specific areas like payment and cost tracking.

Here is our detailed selection criteria while selecting these programs:

- Ease of Use: Before we dive into the features of an accounting software, the user interface matters a lot. As a sales rep, most of your work happens on-site, and you don’t want to spend hours navigating the program. Complex interfaces require a higher learning curve and are prone to mistakes. That’s why ease of use has been one of our priorities when selecting the software.

- Sales Features: The main reason you want an accounting tool is that you can efficiently manage your administrative work, like tracking sales, managing supplier invoices, calculating taxes, and staying on top of cash flow. These programs will save you hours and help you automate recurring tasks.

- Mobile accessibility: A handy mobile application is a must while choosing the right accounting software. You cannot bring your laptop or system everywhere, but with a mobile application, you can instantly handle things like an invoice or a receipt.

- Integrations: A single accounting software might not complete your needs, but with the online integrations, you can manage all the tasks in one place. These software provides easy integrations online.

- Pricing: All these programs offer different tiers of membership for both self-employed individuals and enterprises. We have carefully checked the pricing structure of this software and will give a detailed description later in this article.

- Customer Support: When setting up your program or facing demand in season, you might encounter issues; customer support quality can make or break your experience. Most of these software offer multiple support channels, including phone, email, chat, and comprehensive knowledge bases tailored to service-based businesses.

Top 5 Accounting Programs for Sales Agents/Reps

We’ve done a detailed deep dive into the following software. From their primary use cases to small features, we’ve tried to cover everything so you can make an informed investment in your accounting software.

- Zoho CRM: Best For Client Management and Sales Reporting

- FreshBooks: Best For Overall Accounting For Sales Agents

- Xero: Best for Deeper Financial Insights

- Moss: Best Spend Tracking Solution for Sales Agents

- Melio: Best For Payments

#1 Zoho CRM – Best For Client Management and Sales Reporting

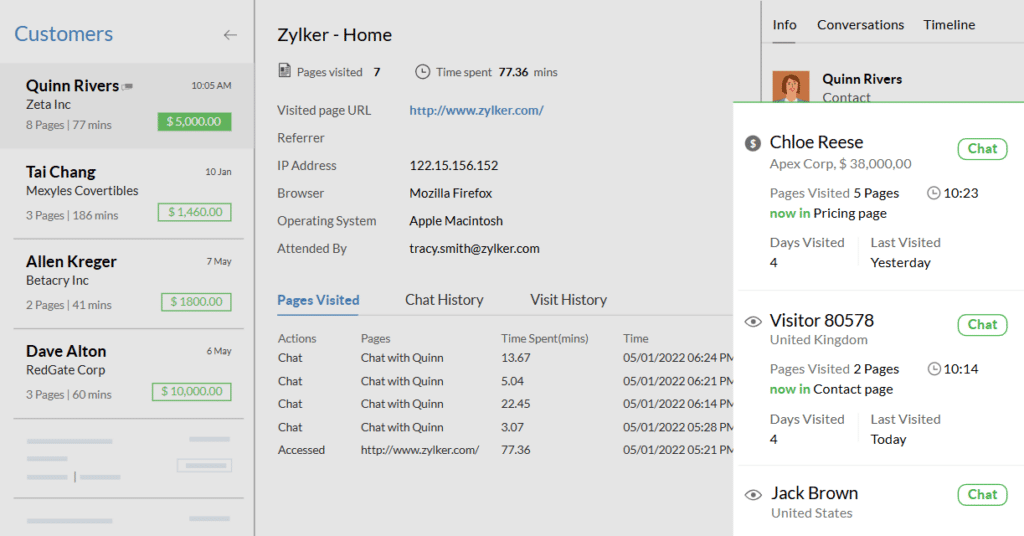

Zoho CRM (Customer Relationship Management) is an advanced client management platform within the Zoho suite. From better sales processes to client management, Zoho CRM provides a wide range of features that can significantly improve the workflow of a sales agent. Its automation features save manual work and time while giving them control and data of the business.

Zoho CRM is an end-to-end client and sales management platform. For basic accounting tasks, such as expense tracking, you need to integrate the Zoho Books program from the Zoho Suite. With this integration, Zoho CRM becomes a complete accounting solution for a salesperson.

Expert score 4.7 |

Key Features

Sales Leads

- With the Zoho sales automation tool, you can generate leads through the website, email, social media, etc.

- These leads will be automatically logged in your CRM contacts.

- With the lead scoring feature, each of your leads gets tags.

- Zoho’s AI, “Zia,” helps you gather more information about your leads, which increases the chances of converting them.

- Omnichannel communication – nurture leads through social media, telephone, live chat, and even in person.

- You can create a targeted campaign at each stage of the sales funnel.

Deal Management

- With a single click, you can convert a lead into a deal with all the information.

- You can create multiple pipelines for different processes according to sales.

- Zia helps you identify which deal has the higher chance of conversion through intelligent conversion.

- Inside the deal module, you create a detailed quote for the client easily.

- An efficient help desk provides complete customer satisfaction.

- Based on your previous interactions with customers, Zia will suggest the best times to contact them.

Account Management

- You can track customer activity, associated contacts, pending deals, and ongoing projects, all in a single place.

- Sales order and payment details are automatically recorded in the CRM program.

- Zoho CRM allows you to generate invoices and collaborate with vendors and partners.

Workflow Automation

- You can automate sales routines with pre-defined rules.

- Zia analyzes your audit logs and activity history to identify patterns in your data and suggests pre-built workflows.

- You can track the effectiveness of the workflow and optimize it according to the needs.

- Zoho CRM also gives you in-depth information about when and where your workflows fail.

CRM Analytics

- You can generate pre-built reports to analyze deals, stages, and contacts.

- Powerful filtering options help you filter your data using criteria based on modules.

- Data visualization through pie charts, heat maps, and bar graphs.

- Zia’s sales forecasting helps you identify which leads will go through.

- You can compare your actual sales performance with the predicted trend to know the deviations from the projected sales pattern.

- Time-based analytics with detailed KPI.

Integrations and Mobile Accessibility

- You can integrate with other Zoho programs for other business needs.

- You can close deals, create reports, and access client data through the mobile application.

- Zoho’s Card Scanner allows you to take a photo of business cards using the camera and import contacts directly into CRM.

Key Benefits for Sales Agents

- One of the best CRM tools to manage clients and sales.

- Efficient automated tools for saving your time and better workflow management.

- Zoho’s AI, Zia, will help you at each stage, from lead to deal and conversion.

- A salesperson can create quotations and invoices with a mobile application easily.

- Zoho CRM analytics is famous for its clarity into the profitability of each lead, sales, and client.

- Full customer satisfaction with efficient help desks.

- Mobile accessibility helps salespeople operate on the site without a computer system.

Zoho: Customer Support

- Chatting System: You can resolve your small queries through live chatting and email support.

- Phone Support: You can contact customer support 24 hours a day, Monday to Friday, to solve your query.

- Guides and code: There are various online resources, like videos and blogs. Additionally, in-house codes are also available to help less tech-savvy sales reps.

Pros and Cons

Pros

-

End-to-end sale process features from lead generation to closing deals

-

Highly customisable, allowing businesses to tailor according to their unique requirements and workflows

-

Zoho CRM integrates with Zoho Suites and third-party applications

Cons

-

High learning curve – too many features

-

Email invitation sometimes faces problems

-

AI features and integration are not available on the free plan

#2 FreshBooks – Best For Overall Accounting For Sales Agents

FreshBooks is the complete accounting solution that offers various functionalities such as invoicing, expense tracking, commission tracking, payments, and reports in one place. The platform is user-friendly; hence, sales reps can keep their bookkeeping and client relations under control in an orderly manner.

FreshBooks also helps sales reps with commission structure and payment schedule, which is beneficial for someone managing multiple clients. Additionally, the platform provides various CRM integrations, including Capsule CRM, Agile CRM, and Zoho CRM, so your client relationship management remains on point.

Expert score 4.5 |

Key Features

Expense Reports

- FreshBooks allows you to connect your bank and automatically record each expense on the sales operation.

- While managing multiple clients, you don’t have to worry about lost receipts.

- You can scan the receipt and automatically categorize and log the expenses.

- Real-time mileage and time tracking for accurate costing.

- You can mark expenses as billable, add a markup, and automatically add them to client invoices.

Invoicing

- You can create branded invoicing with your logo, brand, or company name.

- Various template options are available for you to choose from when creating an invoice.

- For a regular customer, you can set up recurring payments, saving you time and manual work.

- You can monitor every activity of the invoice when the customer receives or views it.

- Immediately after work, invoices can be created on-site with the mobile application.

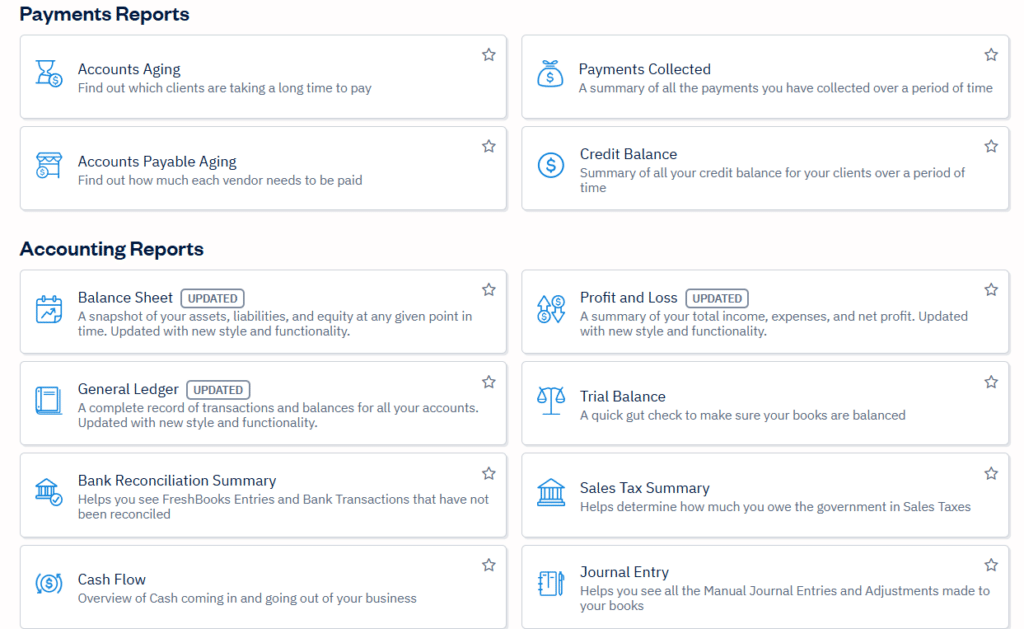

Analytic Reports

- FreshBooks provides an insightful dashboard and reports to help you understand how your sales business is performing.

- FreshBooks allows you to create estimates to quote to clients.

- Accurate profit and loss reports reveal areas for improvement in financial performance.

- Quarterly and annual financial reports will save you time and make tax season stress-free.

CRM Integration and Mobile Accessibility

- FreshBooks offers multiple CRM integration options, including HubSpot, Capsule CRM, and Nocrm.io.

- With the FreshBooks mobile application, you can access almost every feature, including invoicing, automated expense tracking, and payment.

- FreshBooks allows flexible payment methods, such as credit cards, PayPal, Apple Pay, and bank transfers.

- ACH connects to most major banks in the U.S.

- One-click payments can be made through the link in the invoices.

Key Benefits for Sales Agents

- FreshBooks is an all-in-one bookkeeping solution for sales agents.

- Sales agents can create branded quotes and invoices to create a professional image in front of the client.

- Sales agents can track expenses associated with each sale with bank reconciliation.

- A detailed analytical report helps sales agents to improve the plan, which in turn increases profitability.

- With multiple CRM integration options, client management is very easy.

FreshBooks Customer Support

- Dedicated Support Staff Assistance: FreshBooks’ support team has a high rating in the public reviews on Trustpilot- 4.8/5.0. You can contact FreshBooks Support services through phone, email, and chat.

- Comprehensive Knowledge Base: FreshBooks provides an online knowledge base and webinars, offering users information and self-service support options.

Pros and Cons

Pros

-

All the bookkeeping requirements in a single place

-

Easy access and quick payments

-

Easy integrations and excellent customer support

Cons

-

Limitations on the number of users and clients

-

The mobile application doesn’t allow report generation.

-

Limited scalability for small businesses

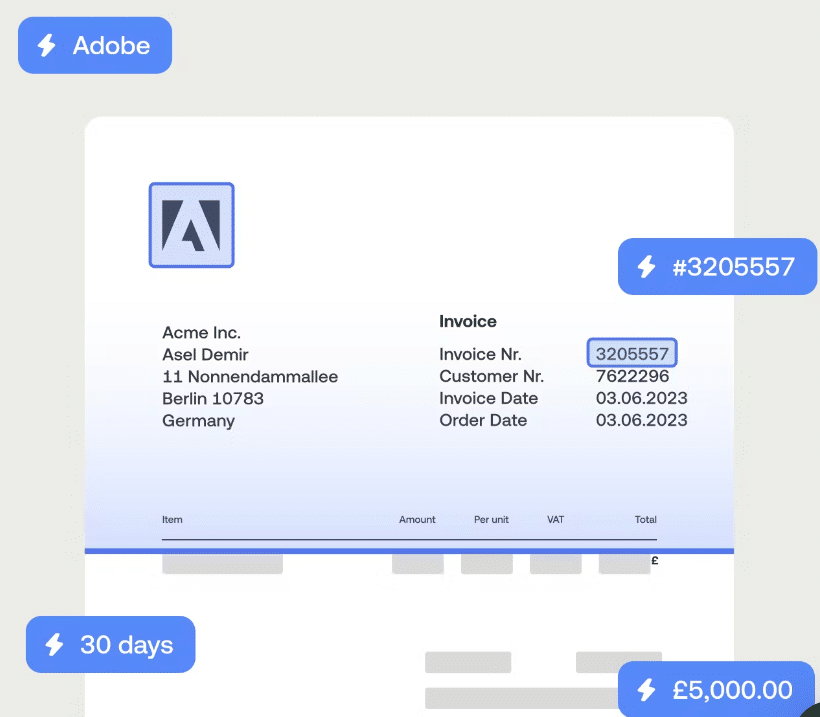

#3 Xero – Best for Deeper Financial Insights Into Your Sales

Xero is a cloud-based accounting platform that specializes in managing multiple revenue streams with robust cash flow management. The platform provides several benefits for sales reps/agents, including a commission calculation, integration with CRM systems, and a payment processor.

Sales agents can track each cost associated with their operations with automation tools like bank reconciliation tools and automatic bank feeds, simplifying transaction categorization and financial tracking. Xero allows unlimited users free of charge, which is not possible in FreshBooks or Zoho.

Expert score 4.3 |

Key Features

Budgeting and Invoicing

- You can generate instant quotes and budgets after you meet with clients.

- Customizable invoice generation helps create a professional image in front of your customers.

- With Xero’s invoicing, you can embed a payment link in the invoice itself to get paid faster.

- Xero allows to automate and set automatic reminders for payments and recurring invoices.

Cash Flow Management

- Xero offers multiple cash flow management tools to help you stay ahead of your finances.

- You can link your bank to Xero to get a real-time view of your cash flow.

- Track receivables from clients in one click and set reminders.

- With Xero’s cash flow forecast feature, you can deal with seasonal cash flow variations.

- You can place alerts for specific thresholds in your cash flow, saving you from last-minute headaches.

Expense Tracking

- You can track accurate time and mileage with Xero’s tracker features.

- Link your bank account, and the program will update expenses and categorize them according to each sale.

- You can upload all the expenses from any receipt with a single snapshot.

- See where each dollar was spent to help you manage your project budgets.

- Bank reconciliation helps you keep records up to date.

Integrations and Analytics

- Xero supports multiple CRM integrations, including HubSpot, Capsule, and Prospect.

- Xero provides tracking of depreciation on your assets, saving time for taxes.

- The profitability dashboard provides a detailed view of your financial condition, including a profit and loss statement.

- You can monitor the breakdown of costs, including areas that need improvement.

Key Benefits For Sales Reps/Agents

- Robust financial controls integrating predictive analytics and bank reconciliation functionalities enabled sales agents to keep their financial portfolio at the top.

- The user-friendly interface helps them move faster.

- Sales reps can produce attractive invoices and estimates for their customers.

- Tax reports that show tax obligations can be obtained using Xero.

- With Xero’s mobile application, you can give quotes and estimates on-site to close the deal immediately.

Xero: Customer Support

- No phone support: Xero does not offer phone support to its customers, which is a notable limitation. In case of any problem or query, please reach out to us via email support.

- Xero Central: Xero has created a dedicated online webpage that provides information on various topics.

Pros and Cons

Pros

-

Diverse integration options, mainly for CRM

-

Real-time cash flow tracking and forecasting

-

Track every cost with bank integration and automated receipt upload

Cons

-

Hard to reach customer support, as there is no mobile support

-

The base subscription limits certain features

-

Limited customer service channels

#4 Moss – Best Spend Tracking Solution for Sales Agents

Sales agents facing accounting problems related to expenses and struggling to keep track of costs can find Moss to be an ideal solution. Moss is a cloud-based smart expense management software specifically designed for tailored workflows that track budgets in real time.

For agents who frequently entertain clients or travel for business, Moss’s real-time expense tracking and automated policy enforcement ensure compliance with tax requirements and client reimbursement policies.

Expert score 4.2 |

Key Features

Smarter Spending

- Moss’s automated spend tracking features require minimal input to log data.

- With a single snapshot of the receipt, you can upload the expenses, and it will be categorized automatically.

- The platform lets you issue virtual and physical credit cards with a limited budget.

- Data from card transactions, invoices, and payments is automatically logged in the system.

- Moss’s automatic reconciliation feature helps you save time on account payables during the month-end closing process.

Payments

- Moss offers instant and secure domestic and global payments.

- SEPA instant payments and EEA and UK instant payments.

- An integrated bank account enables instant clearance of account payables, eliminating the need for an external gateway.

- Download the transaction and transaction report at any time to facilitate payment reconciliation.

- Cash back for high transaction volumes on virtual and physical card spending.

Integrations

- Moss allows integrations with major software, such as NetSuite, which offers excellent CRM features.

- Through e-invoicing, Moss reads the data from invoices automatically and then pays directly via Moss or a bank.

- Two-way integrations with leading accounting software keep everything up to date.

Key Benefits For Sales Agents/Reps

- Best smart spend tracking solution for sales agents.

- An automated expense tracker and manager helps sales agents to handle purchases and receivables while saving time and manual work.

- Sales agents can control spending with smart trackers to increase profitability.

- Moss provides proper and accurate documentation of tax reports.

Moss: Customer Support

- Onboarding Support: Moss provides new customers with dedicated onboarding support staff, enabling new users to easily navigate the software.

- Easy use: In 2024, Moss was awarded Capterra’s Best Ease of Use Badge for the Accounts Payable and Expense Report categories.

- Customer Support: You can contact Moss’s customer staff by phone or email from Monday to Friday between 9 a.m. and 4 p.m. Additionally, a help center has been established with detailed articles addressing recurring queries.

Pros and Cons

Pros

-

Automated spend tracking and management

-

CRM and other integrations with major accounting apps

-

Easy to use and set up, with excellent customer support

Cons

-

Need integrations for features like invoice generation

-

Limited customization and regional functionalities

-

Higher pricing for a full feature set

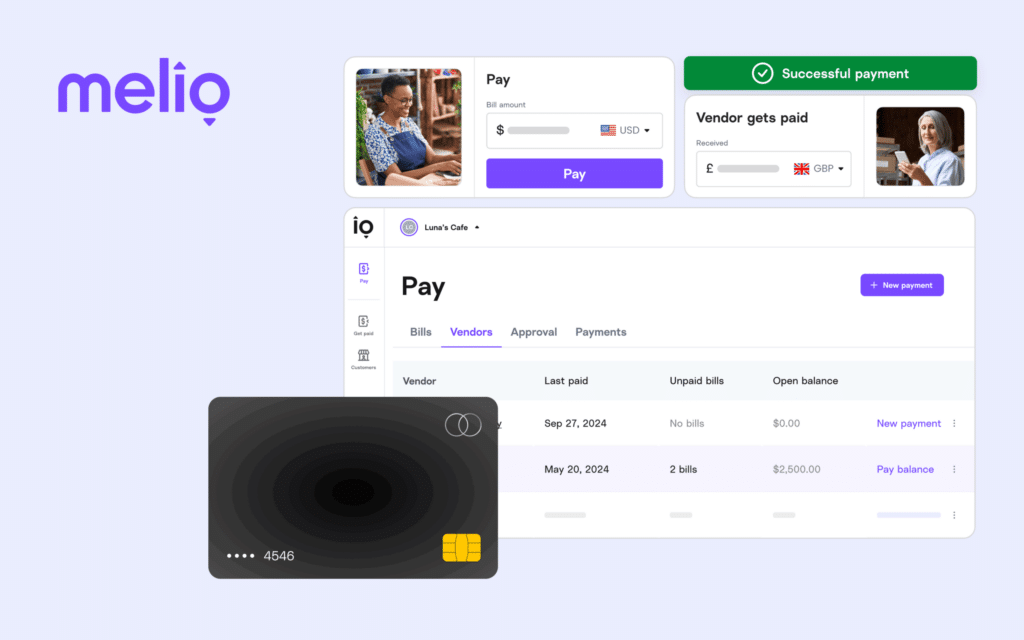

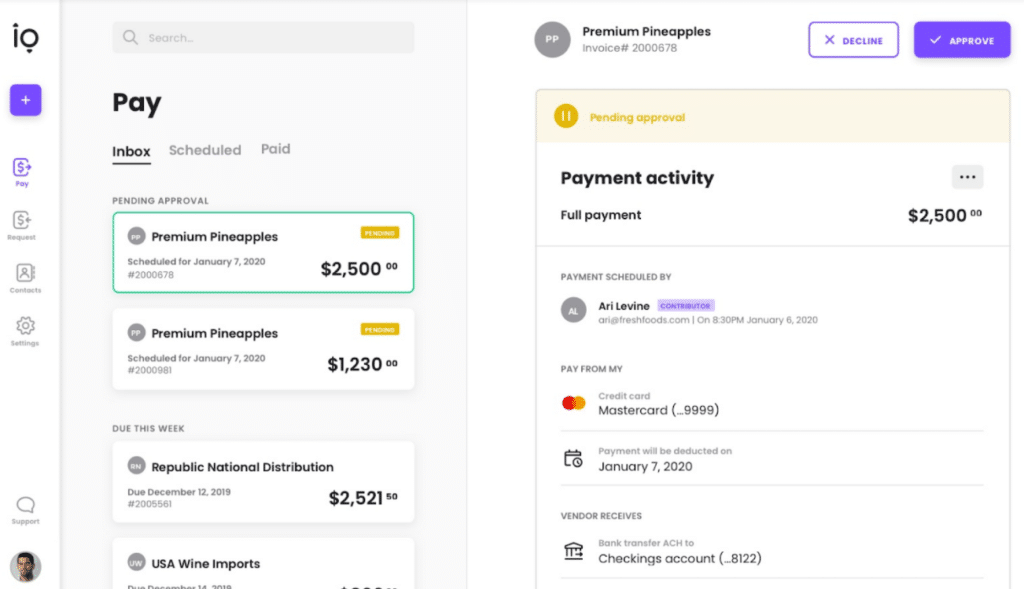

#5 Melio – Best For Payments

Melio is an end-to-end payment solution, making it an excellent choice for agents and representatives who deal with complex payment schedules and multiple vendors. With integrations with top accounting software like FreshBooks and Xero, Melio becomes a complete accounting solution specializing in payments.

Melio makes this process easier and faster with the help of an intuitive payment management system. Moreover, it allows you to make payments that match your cash flow and pay vendors by credit card.

Expert score 4.1 |

Key Features

Payment Capabilities

- Diverse payment options include credit card, bank transfer, and checks.

- With Melio, you can pay via credit card, and the payment will be sent in the form of a check.

- Melio offers 50% time savings on bill payment processes and no-cost ACH bank transfers.

- You can automate your recurring expense payment to save time setting up payments each time.

- Melio offers 50% time savings on bill payment processes and no-cost ACH bank transfers.

- You can generate branded personalized payment links that accept debit or credit cards.

- Instant payment transfer capabilities so you don’t have to wait for payments.

Integrations and Workflow

- Integrations are available with top accounting programs like Xero and FreshBooks.

- Automatic receipt reading is available, saving you the time and effort of manual logging.

- You can efficiently manage and track payments to suppliers and subcontractors, helping to maintain project schedules and avoid delays.

- A handy mobile application for on-site payment requests.

- In-depth analysis of payment transactions offers key insights into spending trends and outstanding payables.

Key Benefits For Sales Agents/Reps

- Perfect solution for a sales agent facing difficulties with payments.

- Global payment options with high security.

- Improves cash flow management by providing greater control over when payments are sent and received, enabling sales agents to manage their working capital better.

Melio: Customer Support

- Premium Support: Dedicated support service via phone, chat, and email.

- Informative Help Center: Melio offers a help center with FAQs, articles, and guides to answer common questions about using the platform and making payments.

Pros and Cons

Pros

-

All-in-one payment solution, both domestic and international

-

Cash flow management through an automated workflow

-

Simple user interface and no monthly fees

Cons

-

Payment-focused software needs integrations for bookkeeping

-

No CRM integration option available

-

International payments are limited to USD. For a flat fee of $20 USD per payment.

Top 5 Accounting Applications for Sales Agents/Reps: Comparison Table

| Feature | Zoho CRM | FreshBooks | Xero | Moss | Melio |

|---|---|---|---|---|---|

| General Accounting | ✓ | ✓ | ✓ | ✓ | ✓ |

| Core Accounting | ✓ | ✓ | ✓ | No (Focuses on Expenses) | No (Focuses on Payments) |

| Invoicing | ✓ | ✓ | ✓ | No (Manages Expenses Related to Invoices) | Facilitates Payment of Invoices |

| Expense Tracking | ✓ | ✓ | ✓ | ✓ | Manages Payment Outflow |

| Financial Reporting | ✓ | ✓ | ✓ | Spending Reports | Payment Reports |

| Sales-Specific Needs | ✓ | ✓ | ✓ | ✓ | ✓ |

| Job Costing | ✓ | ✓ | ✓ | Yes (Expense Tracking) | Contributes by Streamlining Payments |

| Project Management | Yes (Basic) | Yes (Basic) | Yes (Basic) | Contributes by Tracking Project Expenses | Contributes by Ensuring Timely Payments |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| On-Site Invoicing | ✓ | ✓ | ✓ | No Direct Invoicing, Manages Related Expenses | No Direct Invoicing, Facilitates Payments |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Online Payment Processing | ✓ | ✓ | ✓ | Manages Expenses Related to Payments | Core Functionality |

| Bank Reconciliation | ✓ | ✓ | ✓ | Integrates with Accounting Software | Integrates with Accounting Software |

| Corporate Cards | No | No | No | ✓ | No |

| Automated Receipt Capture | ✓ | Yes (AI-Powered) | ✓ | Yes (AI-Powered) | ✓ |

| Integrations | ✓ | ✓ | ✓ | Integrates with Accounting Software | Integrates with Accounting Software |

| User-Friendliness | Varies | Generally High | Generally High | Generally High | High |

| Scalability | High | High | High | Good | Good |

| Best For | Client Management and Sales Reporting | Overall Accounting For Sales Agents | Deeper Financial Insights | Spend Tracking | Payment Processing |

Without Good Accounting Software, You’re Missing Out

For agents and representatives, inadequate accounting doesn’t just mean administrative headaches—it has a direct effect on your bottom line and professional reputation. Failure to perform proper financial tracking puts you at risk of significant financial and operational consequences.

Commission Management: Commission-based professionals often lose track of what they’re owed. Without systematic tracking, it’s easy to miss when clients underpay commissions or violate payment timelines.

Expense Allocation: Expense allocation is quite challenging for agents when representing multiple clients. If you are not using proper accounting tools, it is easy to miss tax deductions for legitimate business expenses or fail to bill reimbursable expenses to the appropriate clients.

Reporting: Clients expect clear statements of commissions earned, expenses incurred, and payments processed. Your credibility with clients depends on accurate financial reporting, and without professional accounting tools, there is an increased risk of errors or delays in reporting, which can undermine client confidence.

Cash Flow Improvement: Payment trend analysis helps with cash flow management by identifying clients with consistently delayed payments. It allows you to implement appropriate payment terms and focus on more reliable relationships.

Tax Compliance: Tax compliance is another critical area where inadequate accounting creates risk. Agents often have complex tax situations, including state taxes for multi-state representation and potentially international tax considerations. If you don’t keep proper records, you risk costly penalties and missed deductions.

Insight into the Financial Situation of Your Sales Business

With proper accounting tools, you gain clear visibility into which clients generate the most profit for your business. It goes beyond simple revenue tracking to account for time invested, expenses incurred, and collection efficiency for each relationship. One insurance agent discovered that his highest-revenue client was actually among his least profitable when accounting for time spent and delayed payments.

Client-specific reports enable you to identify which types of deals yield the highest returns. A literary agent discovered that while film rights negotiations consumed more time, they yielded significantly higher effective hourly rates than book deal negotiations, leading her to adjust her business development strategy.

Payment trend analysis can improve cash flow management. Identifying clients with consistently delayed payments will enable you to implement appropriate payment terms or prioritize more reliable relationships. Such insights directly translate to strategic business decisions like which clients to prioritize, which services to emphasize, and how to structure commission agreements for optimal profitability.

Price Information Per Program

It’s very important for you to take into consideration the price of each accounting software when you are making your choice. The following are the details about the cost structures for each of the systems we have talked about. Prices are subject to change, so it is advisable that you visit the software provider’s website to confirm the latest information.

Zoho CRM pricing

Zoho uses a subscription-based model.

Plans include:

| Tier | Plan |

|---|---|

| Standard | $0 (Offers access for up to 3 users – limited access) |

| Professional | $23 (Per user) |

| Premium | $14 (Per user) |

| Elite | $40 (Per user) |

| Ultimate | $52 (per User) |

Note: Zoho offers a 14-day free trial for the Standard and Premium plans. Prices are exclusive of local taxes.

FreshBooks pricing

FreshBooks uses a subscription-based model. Plans include (USD/month, with 70% off for 4 months):

| Tier | Plan |

|---|---|

| Lite | $6.30 (was $21.00) |

| Plus | $11.40 (was $38.00) – Most Popular |

| Premium | $19.50 (was $65.00) |

| Select | Contact for pricing. |

| Add-ons | Available for Advanced Payments ($20/month), Team Members ($11/person/month), and FreshBooks Payroll ($40/month plus $6/month per user). FreshBooks offers a 30-day money-back guarantee. |

Note: FreshBooks offers a 30-day free trial and a 30-day money-back guarantee.

Xero pricing

Xero uses a subscription-based pricing model. Plans include (USD per month):

| Tier | Plan |

|---|---|

| Starter | Usually $29, now $2.90 for 3 months. |

| Standard | Usually $46, now $4.60 for 3 months. |

| Premium | Usually $69, now $6.90 for 3 months. |

| Add-ons | Additional costs for optional features like expenses, projects, and analytics plus may apply. |

Note: Xero offers a 30-day free trial.

Moss pricing

Moss uses a modular pricing structure, determined by the chosen spend modules and add-ons, as well as the volume of transactions.

- Moss offers a free option for Corporate Cards (up to 3 users) and Accounts Payable (up to 20 invoices per month). Eligibility verification may be required.

- Pricing is customized by choosing spend modules (Corporate Cards, Employee Reimbursements, Accounts Payable), add-ons (Advanced Controlling, Advanced Accounting, Procurement, ERP), and transaction volume.

Melio pricing

Melio’s pricing is primarily focused on transactions. There are generally no fees to receive payments.

- Fees may apply for certain payment methods, such as instant transfers.

When evaluating the cost of accounting software, consider not only the subscription fee but also potential additional costs, such as:

- Fees for extra users

- Add-ons or integrations

- Transaction fees

- Support costs (if applicable)

It’s also a good idea to take advantage of free trials to test the software and see if it meets your needs before committing to a paid plan.

| Product |

|

|

|

|

|

|---|---|---|---|---|---|

| Learn more | >>> Learn More | >>> Learn More | >>> Learn More | >>> Learn More | >>> Learn More |

| Free trail period | 14 days | 30 days | 30 days | 30 days | 30 days |

| Starting price | $10 p/month | $6.30 p/month | $2.90 p/month | Free | $19 p/month |

| Mobile Accessibility | ✓ | ✓ | ✓ | ✓ | ✓ |

| Payments and Banking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Integration options | ✓ | ✓ | ✓ | ✓ | ✓ |

| Rating | 4.7 / 5 | 4.5 / 5 | 4.3 / 5 | 4.2 / 5 | 4.1 / 5 |

Frequently Asked Questions

Yes, specialized accounting software is important for agents and representatives whose income relies on accurate commission tracking across multiple clients and deals. While spreadsheets might suffice for very simple operations, dedicated accounting software becomes essential as your client roster grows.

While hiring an accountant is valuable for tax strategy and financial advice, accounting software and professional accounting services serve complementary rather than competitive roles for agents and representatives.

For agents and representatives, accounting software delivers unique benefits beyond basic bookkeeping with various benefits like, commission tracking, client profitability analysis, expense allocation, tax compliance, etc. It positively impacts your bottom line through improved commission collection, better client selection, and reduced administrative time.

Analyze Needs: Before choosing a platform, collect and organize all your existing financial records, commission agreements, and expense documentation.

Start with the basics: Initially, focus on essential features such as basic commission tracking, expense recording, and client management, and gradually move to more advanced features when you’ve mastered the fundamentals.

Leverage free training resources: All of the platforms recommended offer free webinars and tutorial videos to help you build a strong knowledge base. Dedicate 1-2 hours every week to learn and practice until you feel comfortable.

Related articles

Best Accounting Software For Plumbers

Boost your plumbing business’s financial health. Explore top accounting software for easy invoicing, expense control, and data-driven growth.

Best Accounting Software for Retailers

Looking for the best accounting software for your Retail business? Compare top accounting solutions with features designed to help retailers save time and maximize profits.

Best Accounting Software for Landscapers

Discover the best accounting software for landscapers to track seasonal income, manage equipment costs, and maximize tax deductions while spending more time in the field and less on paperwork

Mark Rosbergen

Expert business software

About Software Pointer

Softwarepointer.com is a platform that was created from a lot of passion for the accountancy profession. Founder Mark Rosbergen started the platform with aim of helping people with their entrepreneurial questions, especially in the field of accounting. With more dan 20 years of experience in accountancy, entrepreneurs are helped every day tot move forward with their business. How? Offering solutions for all entrepreneurial issues in the form of comparison tools, templates, rich articles and tops! We help your company move forward.